Generating synthetic transactional profiles

Paper and Code

Oct 28, 2021

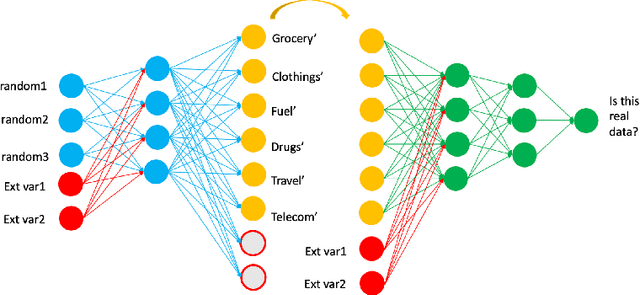

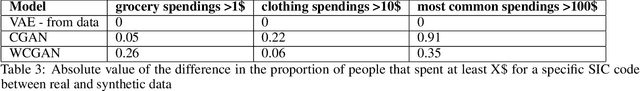

Financial institutions use clients' payment transactions in numerous banking applications. Transactions are very personal and rich in behavioural patterns, often unique to individuals, which make them equivalent to personally identifiable information in some cases. In this paper, we generate synthetic transactional profiles using machine learning techniques with the goal to preserve both data utility and privacy. A challenge we faced was to deal with sparse vectors due to the few spending categories a client uses compared to all the ones available. We measured data utility by calculating common insights used by the banking industry on both the original and the synthetic data-set. Our approach shows that neural network models can generate valuable synthetic data in such context. Finally, we tried privacy-preserving techniques and observed its effect on models' performances.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge