Gated deep neural networks for implied volatility surfaces

Paper and Code

May 26, 2019

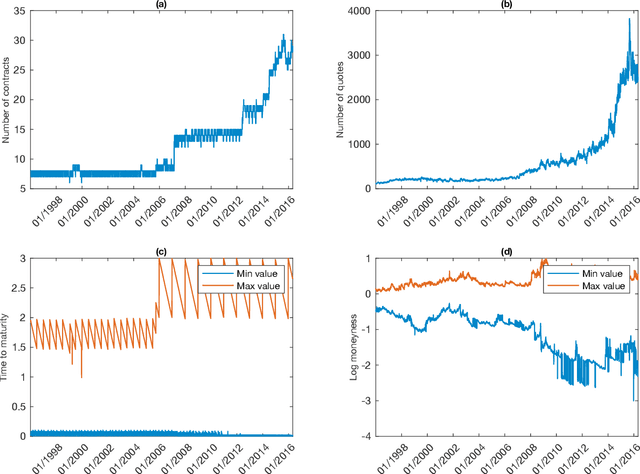

This paper presents a framework of developing neural networks for predicting implied volatility surfaces. Conventional financial conditions and empirical evidence related to the implied volatility are incorporated into the neural network architecture design and model training including no static arbitrage, boundaries, asymptotic slope and volatility smile. They are also satisfied empirically by the option data on the S&P 500 index over twenty years. The developed neural network model and its simplified variations outperform the widely used surface stochastic volatility inspired (SSVI) model on the mean average percentage error in both in-sample and out-of-sample datasets. This study has two main methodological contributions. First, an accurate deep learning prediction model is developed and tailored to implied volatility surfaces. Second, a framework, which seamlessly combines data-driven models with financial theories, can be extended and applied to solve other related business problems.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge