Extreme Volatility Prediction in Stock Market: When GameStop meets Long Short-Term Memory Networks

Paper and Code

Mar 09, 2021

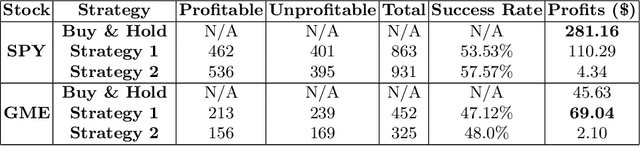

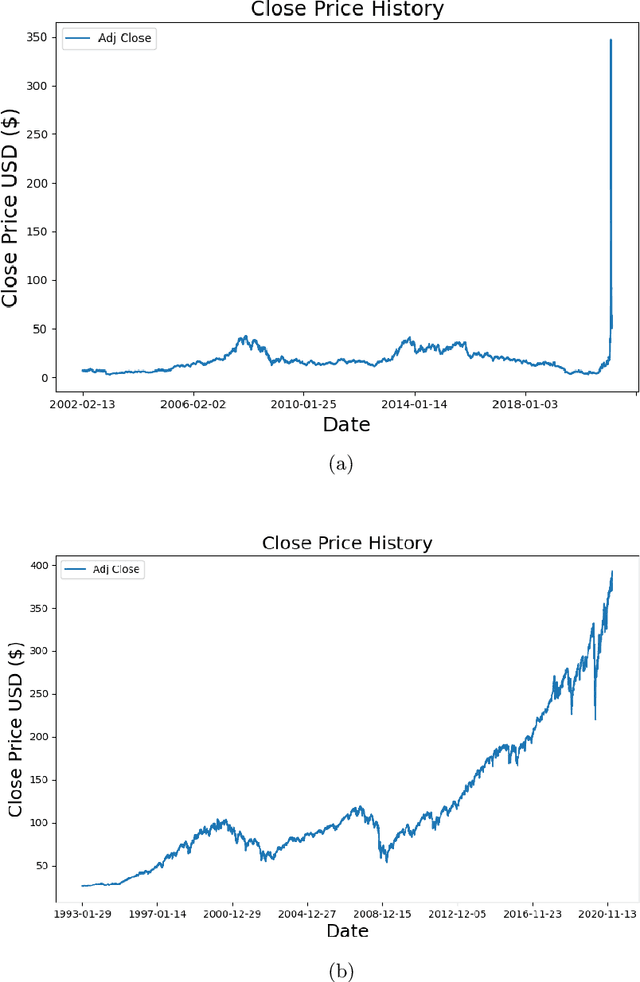

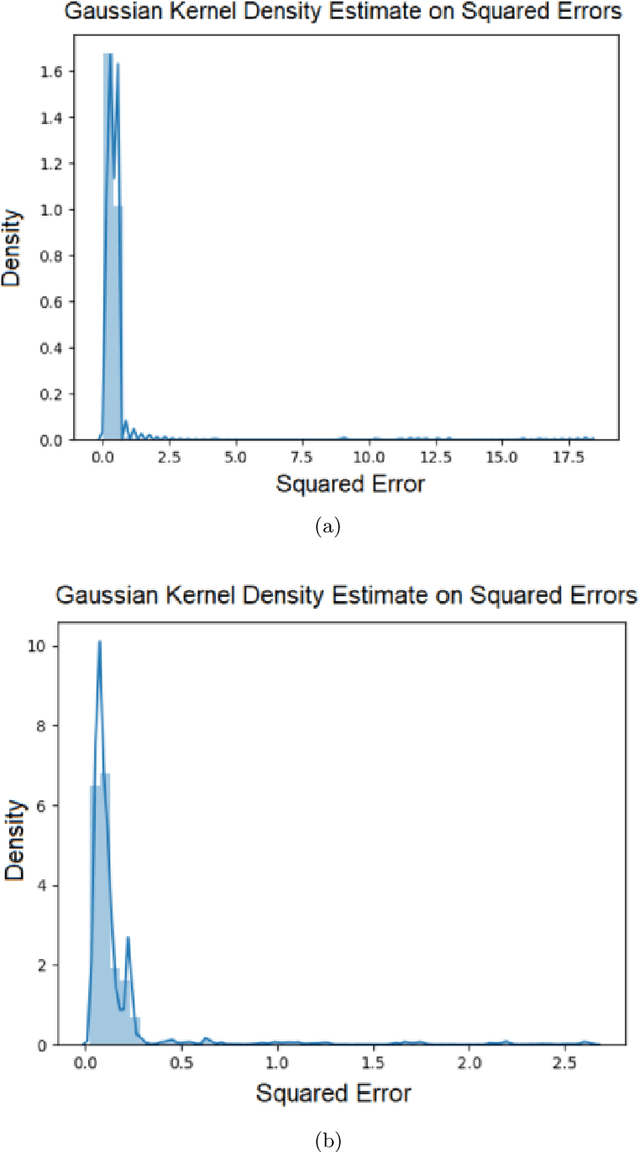

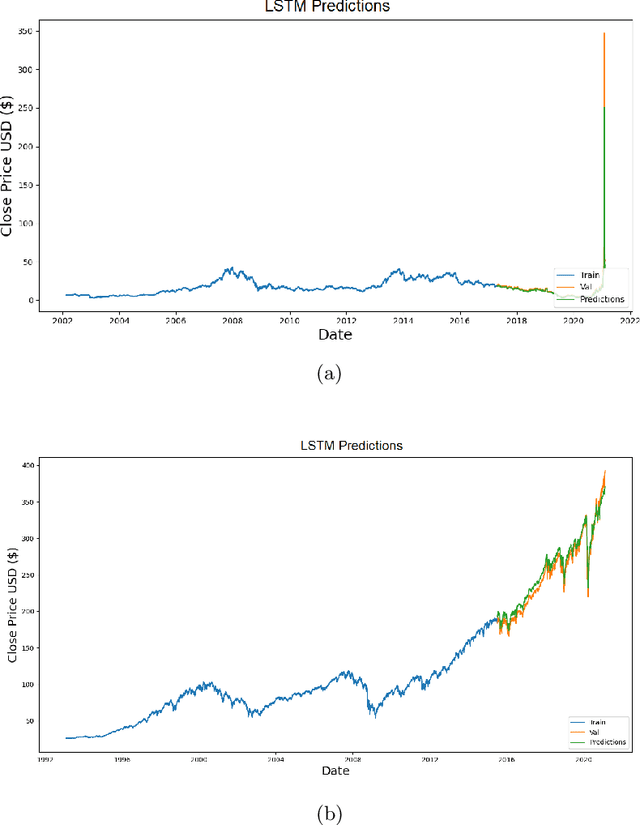

The beginning of 2021 saw a surge in volatility for certain stocks such as GameStop company stock (Ticker GME under NYSE). GameStop stock increased around 10 fold from its decade-long average to its peak at \$485. In this paper, we hypothesize a buy-and-hold strategy can be outperformed in the presence of extreme volatility by predicting and trading consolidation breakouts. We investigate GME stock for its volatility and compare it to SPY as a benchmark (since it is a less volatile ETF fund) from February 2002 to February 2021. For strategy 1, we develop a Long Short-term Memory (LSTM) Neural Network to predict stock prices recurrently with a very short look ahead period in the presence of extreme volatility. For our strategy 2, we develop an LSTM autoencoder network specifically designed to trade only on consolidation breakouts after predicting anomalies in the stock price. When back-tested in our simulations, our strategy 1 executes 863 trades for SPY and 452 trades for GME. Our strategy 2 executes 931 trades for SPY and 325 trades for GME. We compare both strategies to buying and holding one single share for the period that we picked as a benchmark. In our simulations, SPY returns \$281.160 from buying and holding one single share, \$110.29 from strategy 1 with 53.5% success rate and \$4.34 from strategy 2 with 57.6% success rate. GME returns \$45.63 from buying and holding one single share, \$69.046 from strategy 1 with 47.12% success rate and \$2.10 from strategy 2 with 48% success rate. Overall, buying and holding outperforms all deep-learning assisted prediction models in our study except for when the LSTM-based prediction model (strategy 1) is applied to GME. We hope that our study sheds more light into the field of extreme volatility predictions based on LSTMs to outperform buying and holding strategy.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge