Explaining Indian Stock Market through Geometry of Scale free Networks

Paper and Code

Apr 06, 2024

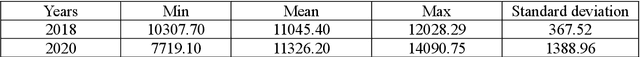

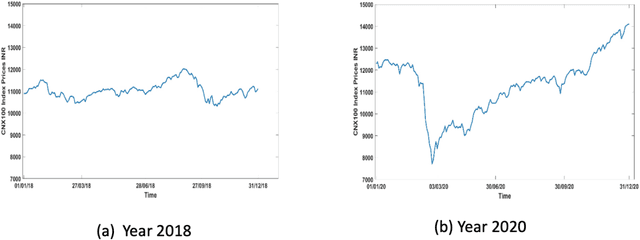

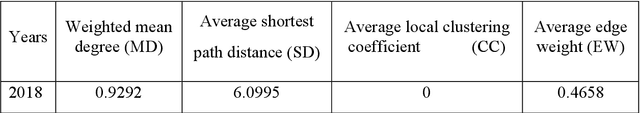

This paper presents an analysis of the Indian stock market using a method based on embedding the network in a hyperbolic space using Machine learning techniques. We claim novelty on four counts. First, it is demonstrated that the hyperbolic clusters resemble the topological network communities more closely than the Euclidean clusters. Second, we are able to clearly distinguish between periods of market stability and volatility through a statistical analysis of hyperbolic distance and hyperbolic shortest path distance corresponding to the embedded network. Third, we demonstrate that using the modularity of the embedded network significant market changes can be spotted early. Lastly, the coalescent embedding is able to segregate the certain market sectors thereby underscoring its natural clustering ability.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge