Enhancing Stock Market Prediction with Extended Coupled Hidden Markov Model over Multi-Sourced Data

Paper and Code

Sep 02, 2018

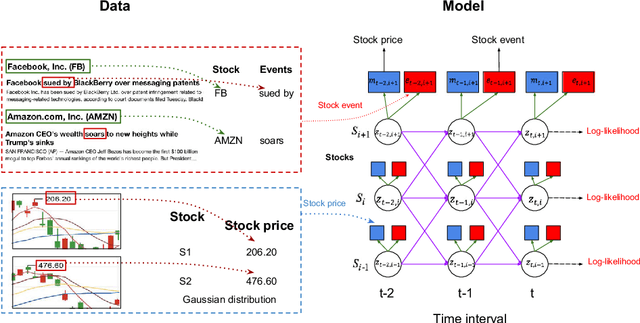

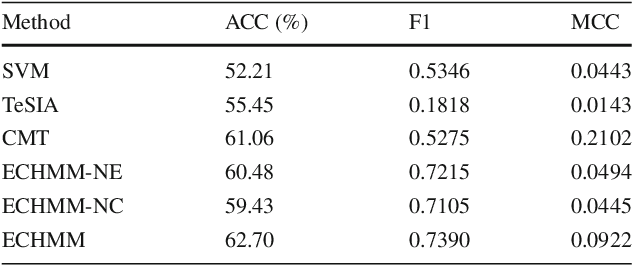

Traditional stock market prediction methods commonly only utilize the historical trading data, ignoring the fact that stock market fluctuations can be impacted by various other information sources such as stock related events. Although some recent works propose event-driven prediction approaches by considering the event data, how to leverage the joint impacts of multiple data sources still remains an open research problem. In this work, we study how to explore multiple data sources to improve the performance of the stock prediction. We introduce an Extended Coupled Hidden Markov Model incorporating the news events with the historical trading data. To address the data sparsity issue of news events for each single stock, we further study the fluctuation correlations between the stocks and incorporate the correlations into the model to facilitate the prediction task. Evaluations on China A-share market data in 2016 show the superior performance of our model against previous methods.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge