Discovering Novel Customer Features with Recurrent Neural Networks for Personality Based Financial Services

Paper and Code

Sep 24, 2021

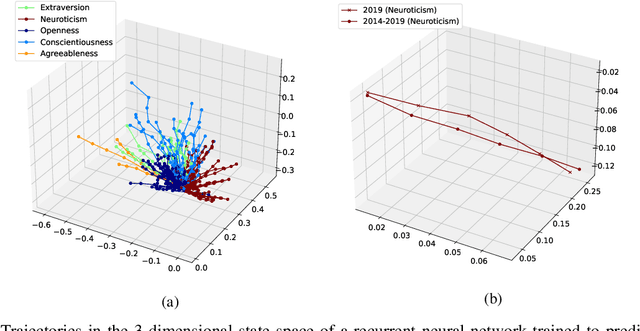

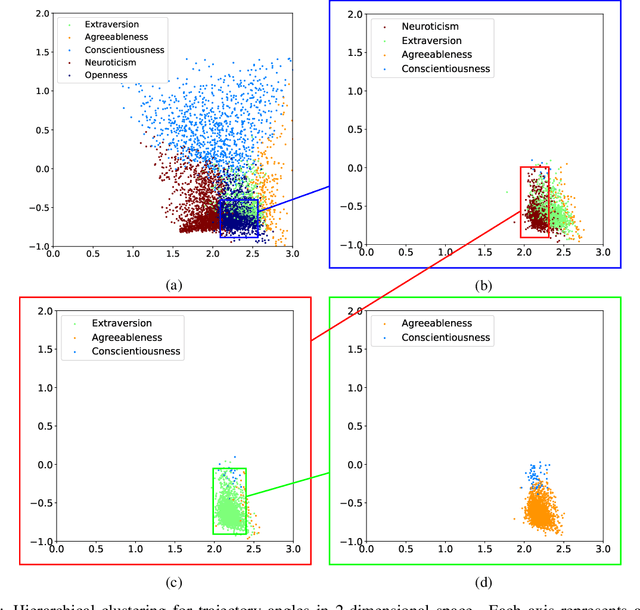

The micro-segmentation of customers in the finance sector is a non-trivial task and has been an atypical omission from recent scientific literature. Where traditional segmentation classifies customers based on coarse features such as demographics, micro-segmentation depicts more nuanced differences between individuals, bringing forth several advantages including the potential for improved personalization in financial services. AI and representation learning offer a unique opportunity to solve the problem of micro-segmentation. Although ubiquitous in many industries, the proliferation of AI in sensitive industries such as finance has become contingent on the imperatives of responsible AI. We had previously solved the micro-segmentation problem by extracting temporal features from the state space of a recurrent neural network (RNN). However, due to the inherent opacity of RNNs our solution lacked an explanation - one of the imperatives of responsible AI. In this study, we address this issue by extracting an explanation for and providing an interpretation of our temporal features. We investigate the state space of our RNN and through a linear regression model reconstruct the trajectories in the state space with high fidelity. We show that our linear regression coefficients have not only learned the rules used to create the RNN's output data but have also learned the relationships that were not directly evident in the raw data.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge