Discovering Bayesian Market Views for Intelligent Asset Allocation

Paper and Code

Jun 29, 2018

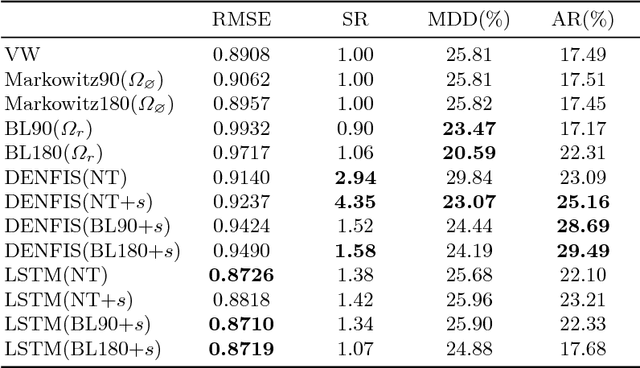

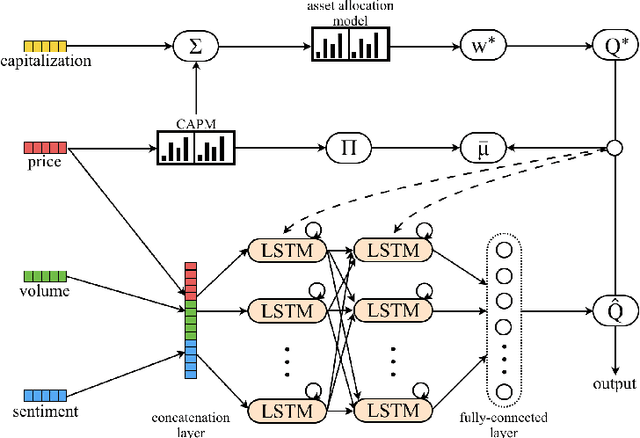

Along with the advance of opinion mining techniques, public mood has been found to be a key element for stock market prediction. However, how market participants' behavior is affected by public mood has been rarely discussed. Consequently, there has been little progress in leveraging public mood for the asset allocation problem, which is preferred in a trusted and interpretable way. In order to address the issue of incorporating public mood analyzed from social media, we propose to formalize public mood into market views, because market views can be integrated into the modern portfolio theory. In our framework, the optimal market views will maximize returns in each period with a Bayesian asset allocation model. We train two neural models to generate the market views, and benchmark the model performance on other popular asset allocation strategies. Our experimental results suggest that the formalization of market views significantly increases the profitability (5% to 10% annually) of the simulated portfolio at a given risk level.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge