Deep Reinforcement Learning for Market Making Under a Hawkes Process-Based Limit Order Book Model

Paper and Code

Jul 20, 2022

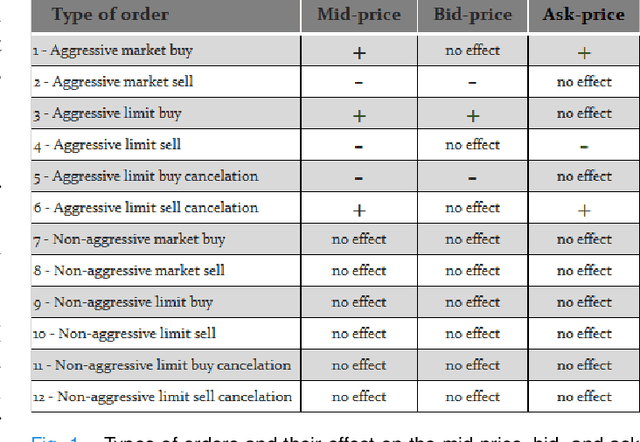

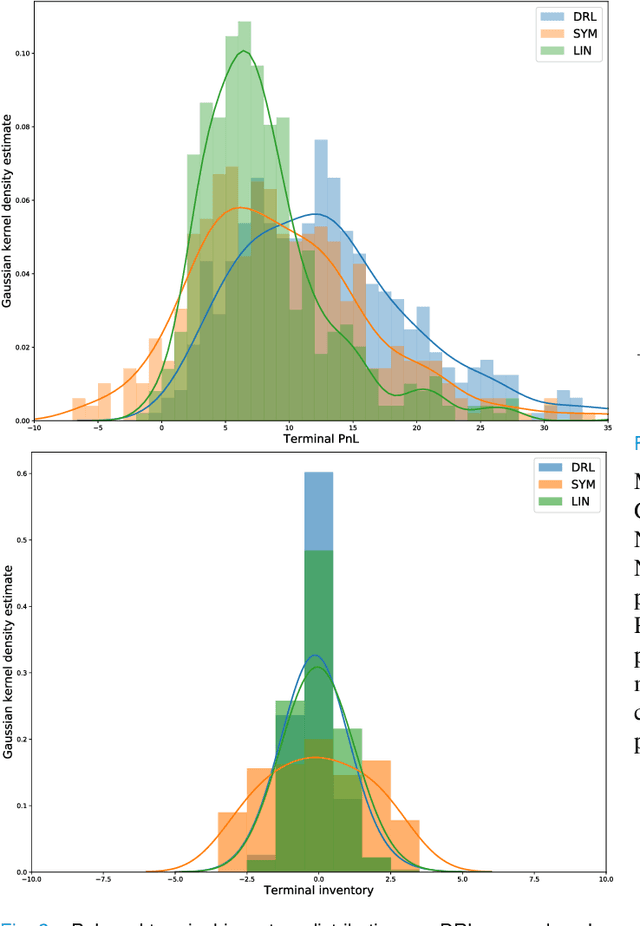

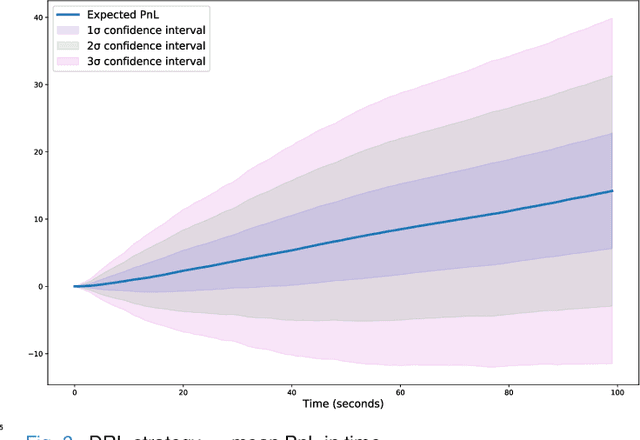

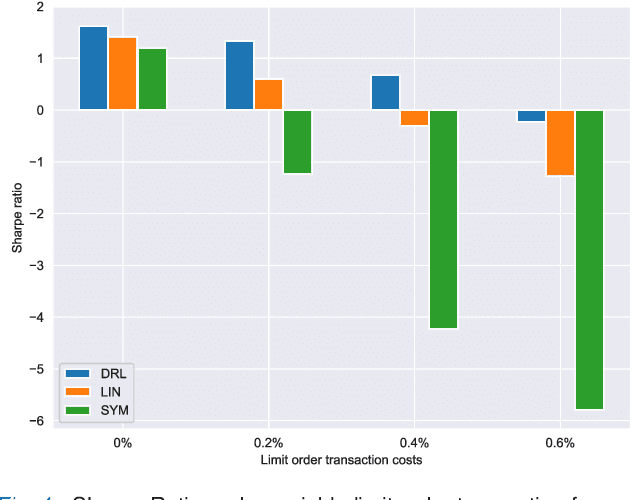

The stochastic control problem of optimal market making is among the central problems in quantitative finance. In this paper, a deep reinforcement learning-based controller is trained on a weakly consistent, multivariate Hawkes process-based limit order book simulator to obtain market making controls. The proposed approach leverages the advantages of Monte Carlo backtesting and contributes to the line of research on market making under weakly consistent limit order book models. The ensuing deep reinforcement learning controller is compared to multiple market making benchmarks, with the results indicating its superior performance with respect to various risk-reward metrics, even under significant transaction costs.

* IEEE Control Systems Letters 6 (2022): 2485-2490 * 6 pages, 4 figures

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge