Crude Oil-related Events Extraction and Processing: A Transfer Learning Approach

Paper and Code

May 01, 2022

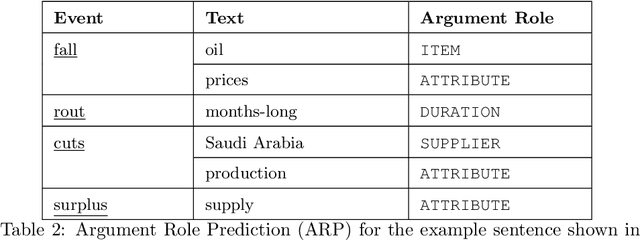

One of the challenges in event extraction via traditional supervised learning paradigm is the need for a sizeable annotated dataset to achieve satisfactory model performance. It is even more challenging when it comes to event extraction in the finance and economics domain, a domain with considerably fewer resources. This paper presents a complete framework for extracting and processing crude oil-related events found in CrudeOilNews corpus, addressing the issue of annotation scarcity and class imbalance by leveraging on the effectiveness of transfer learning. Apart from event extraction, we place special emphasis on event properties (Polarity, Modality, and Intensity) classification to determine the factual certainty of each event. We build baseline models first by supervised learning and then exploit Transfer Learning methods to boost event extraction model performance despite the limited amount of annotated data and severe class imbalance. This is done via methods within the transfer learning framework such as Domain Adaptive Pre-training, Multi-task Learning and Sequential Transfer Learning. Based on experiment results, we are able to improve all event extraction sub-task models both in F1 and MCC1-score as compared to baseline models trained via the standard supervised learning. Accurate and holistic event extraction from crude oil news is very useful for downstream tasks such as understanding event chains and learning event-event relations, which can be used for other downstream tasks such as commodity price prediction, summarisation, etc. to support a wide range of business decision making.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge