Collusion Detection with Graph Neural Networks

Paper and Code

Oct 09, 2024

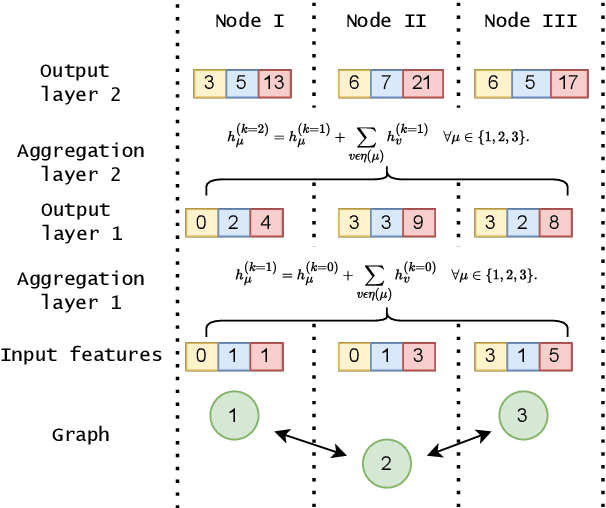

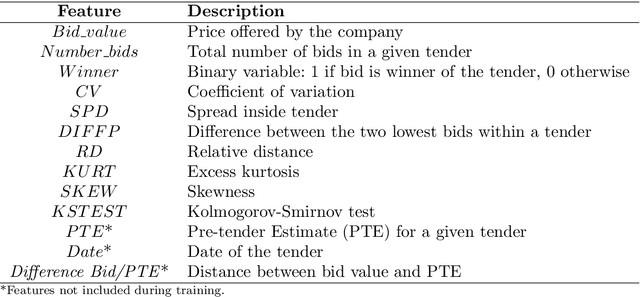

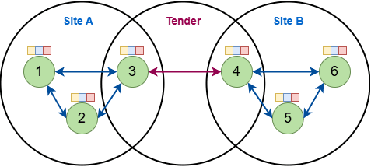

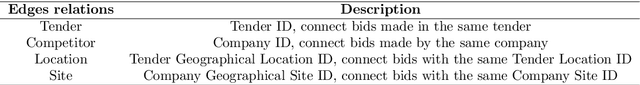

Collusion is a complex phenomenon in which companies secretly collaborate to engage in fraudulent practices. This paper presents an innovative methodology for detecting and predicting collusion patterns in different national markets using neural networks (NNs) and graph neural networks (GNNs). GNNs are particularly well suited to this task because they can exploit the inherent network structures present in collusion and many other economic problems. Our approach consists of two phases: In Phase I, we develop and train models on individual market datasets from Japan, the United States, two regions in Switzerland, Italy, and Brazil, focusing on predicting collusion in single markets. In Phase II, we extend the models' applicability through zero-shot learning, employing a transfer learning approach that can detect collusion in markets in which training data is unavailable. This phase also incorporates out-of-distribution (OOD) generalization to evaluate the models' performance on unseen datasets from other countries and regions. In our empirical study, we show that GNNs outperform NNs in detecting complex collusive patterns. This research contributes to the ongoing discourse on preventing collusion and optimizing detection methodologies, providing valuable guidance on the use of NNs and GNNs in economic applications to enhance market fairness and economic welfare.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge