Choosing Among Interpretations of Probability

Paper and Code

Jan 23, 2013

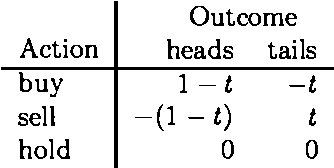

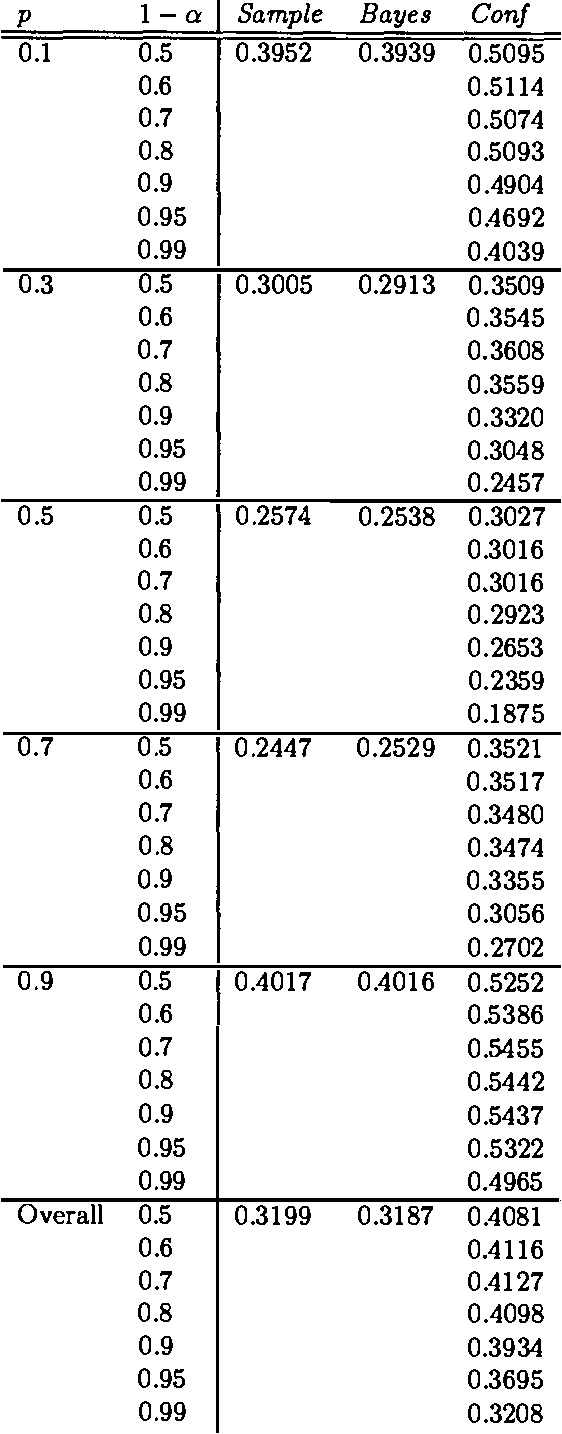

There is available an ever-increasing variety of procedures for managing uncertainty. These methods are discussed in the literature of artificial intelligence, as well as in the literature of philosophy of science. Heretofore these methods have been evaluated by intuition, discussion, and the general philosophical method of argument and counterexample. Almost any method of uncertainty management will have the property that in the long run it will deliver numbers approaching the relative frequency of the kinds of events at issue. To find a measure that will provide a meaningful evaluation of these treatments of uncertainty, we must look, not at the long run, but at the short or intermediate run. Our project attempts to develop such a measure in terms of short or intermediate length performance. We represent the effects of practical choices by the outcomes of bets offered to agents characterized by two uncertainty management approaches: the subjective Bayesian approach and the Classical confidence interval approach. Experimental evaluation suggests that the confidence interval approach can outperform the subjective approach in the relatively short run.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge