Bridging the gap between Markowitz planning and deep reinforcement learning

Paper and Code

Sep 30, 2020

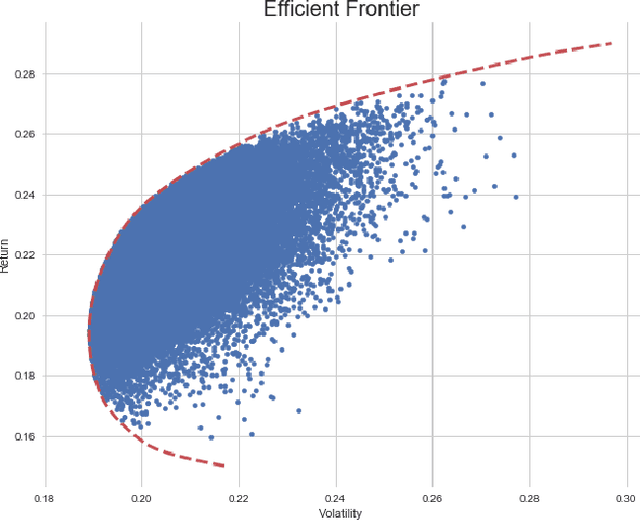

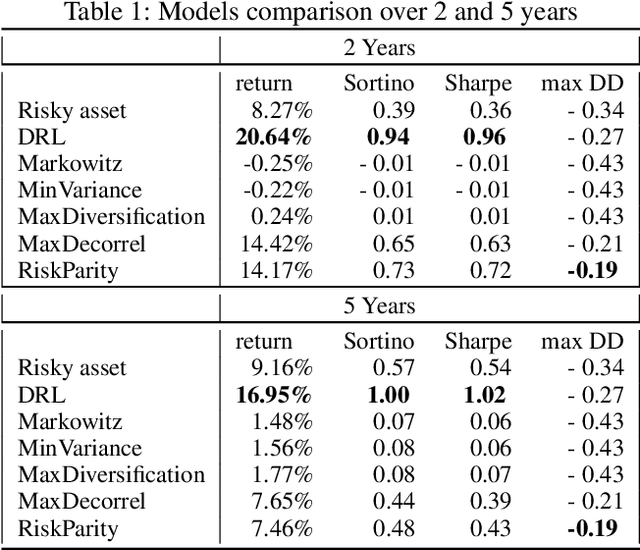

While researchers in the asset management industry have mostly focused on techniques based on financial and risk planning techniques like Markowitz efficient frontier, minimum variance, maximum diversification or equal risk parity, in parallel, another community in machine learning has started working on reinforcement learning and more particularly deep reinforcement learning to solve other decision making problems for challenging task like autonomous driving, robot learning, and on a more conceptual side games solving like Go. This paper aims to bridge the gap between these two approaches by showing Deep Reinforcement Learning (DRL) techniques can shed new lights on portfolio allocation thanks to a more general optimization setting that casts portfolio allocation as an optimal control problem that is not just a one-step optimization, but rather a continuous control optimization with a delayed reward. The advantages are numerous: (i) DRL maps directly market conditions to actions by design and hence should adapt to changing environment, (ii) DRL does not rely on any traditional financial risk assumptions like that risk is represented by variance, (iii) DRL can incorporate additional data and be a multi inputs method as opposed to more traditional optimization methods. We present on an experiment some encouraging results using convolution networks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge