Bid Prediction in Repeated Auctions with Learning

Paper and Code

Jul 26, 2020

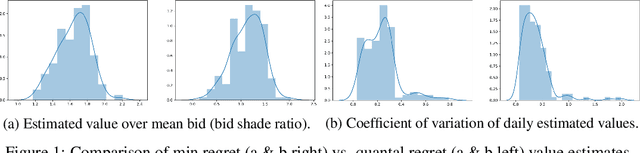

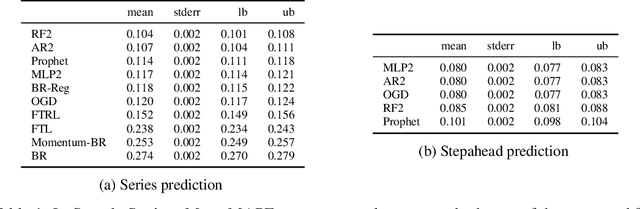

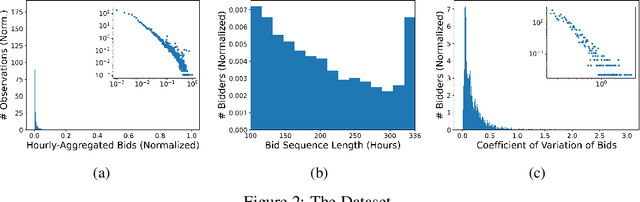

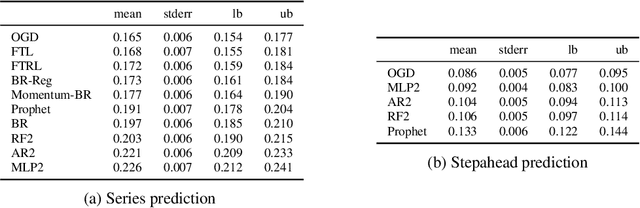

We consider the problem of bid prediction in repeated auctions and evaluate the performance of econometric methods for learning agents using a dataset from a mainstream sponsored search auction marketplace. Sponsored search auctions is a billion dollar industry and the main source of revenue of several tech giants. A critical problem in optimizing such marketplaces is understanding how bidders will react to changes in the auction design. We propose the use of no-regret based econometrics for bid prediction, modelling players as no-regret learners with respect to a utility function, unknown to the analyst. We apply these methods in a real-world dataset from the BingAds sponsored search auction marketplace and show that no-regret econometric methods perform comparable to state-of-the-art time-series machine learning methods when there is no co-variate shift, but significantly out-perform machine learning methods when there is a co-variate shift between the training and test periods. This portrays the importance of using structural econometric approaches in predicting how players will respond to changes in the market. Moreover, we show that among structural econometric methods, approaches based on no-regret learning out-perform more traditional, equilibrium-based, econometric methods that assume that players continuously best-respond to competition.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge