Artificial Prediction Markets for Online Prediction of Continuous Variables-A Preliminary Report

Paper and Code

Aug 11, 2015

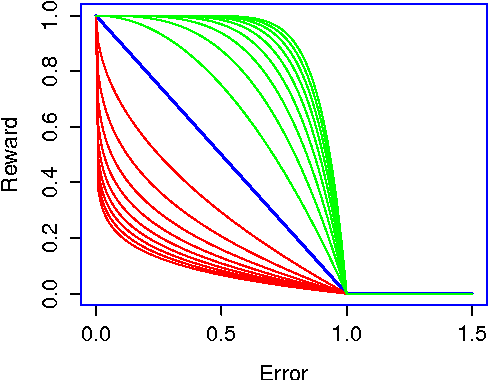

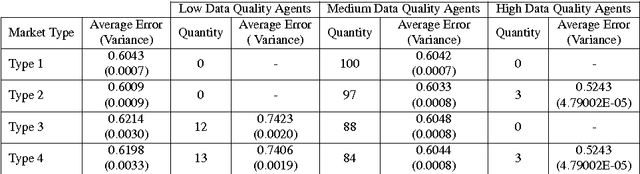

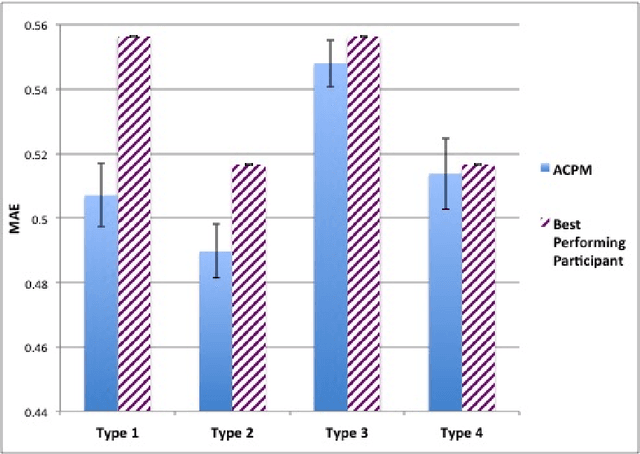

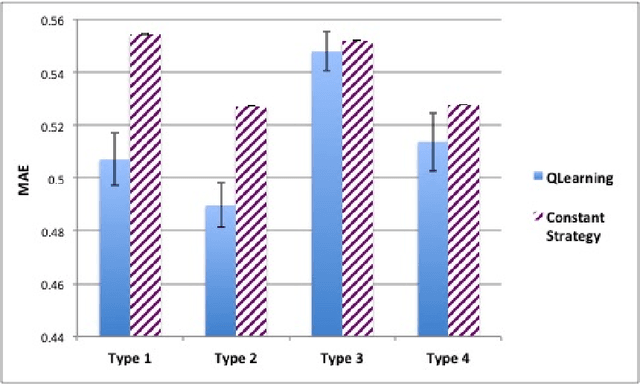

We propose the Artificial Continuous Prediction Market (ACPM) as a means to predict a continuous real value, by integrating a range of data sources and aggregating the results of different machine learning (ML) algorithms. ACPM adapts the concept of the (physical) prediction market to address the prediction of real values instead of discrete events. Each ACPM participant has a data source, a ML algorithm and a local decision-making procedure that determines what to bid on what value. The contributions of ACPM are: (i) adaptation to changes in data quality by the use of learning in: (a) the market, which weights each market participant to adjust the influence of each on the market prediction and (b) the participants, which use a Q-learning based trading strategy to incorporate the market prediction into their subsequent predictions, (ii) resilience to a changing population of low- and high-performing participants. We demonstrate the effectiveness of ACPM by application to an influenza-like illnesses data set, showing ACPM out-performs a range of well-known regression models and is resilient to variation in data source quality.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge