Antithetic Riemannian Manifold And Quantum-Inspired Hamiltonian Monte Carlo

Paper and Code

Jul 05, 2021

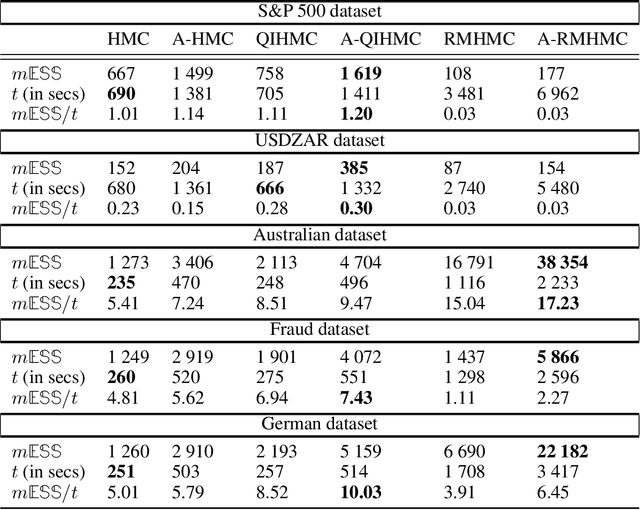

Markov Chain Monte Carlo inference of target posterior distributions in machine learning is predominately conducted via Hamiltonian Monte Carlo and its variants. This is due to Hamiltonian Monte Carlo based samplers ability to suppress random-walk behaviour. As with other Markov Chain Monte Carlo methods, Hamiltonian Monte Carlo produces auto-correlated samples which results in high variance in the estimators, and low effective sample size rates in the generated samples. Adding antithetic sampling to Hamiltonian Monte Carlo has been previously shown to produce higher effective sample rates compared to vanilla Hamiltonian Monte Carlo. In this paper, we present new algorithms which are antithetic versions of Riemannian Manifold Hamiltonian Monte Carlo and Quantum-Inspired Hamiltonian Monte Carlo. The Riemannian Manifold Hamiltonian Monte Carlo algorithm improves on Hamiltonian Monte Carlo by taking into account the local geometry of the target, which is beneficial for target densities that may exhibit strong correlations in the parameters. Quantum-Inspired Hamiltonian Monte Carlo is based on quantum particles that can have random mass. Quantum-Inspired Hamiltonian Monte Carlo uses a random mass matrix which results in better sampling than Hamiltonian Monte Carlo on spiky and multi-modal distributions such as jump diffusion processes. The analysis is performed on jump diffusion process using real world financial market data, as well as on real world benchmark classification tasks using Bayesian logistic regression.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge