An Offline Learning Approach to Propagator Models

Paper and Code

Sep 06, 2023

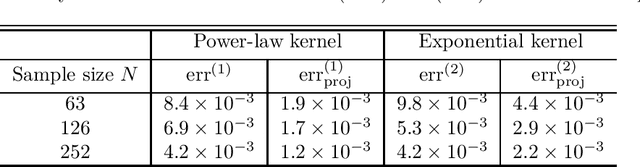

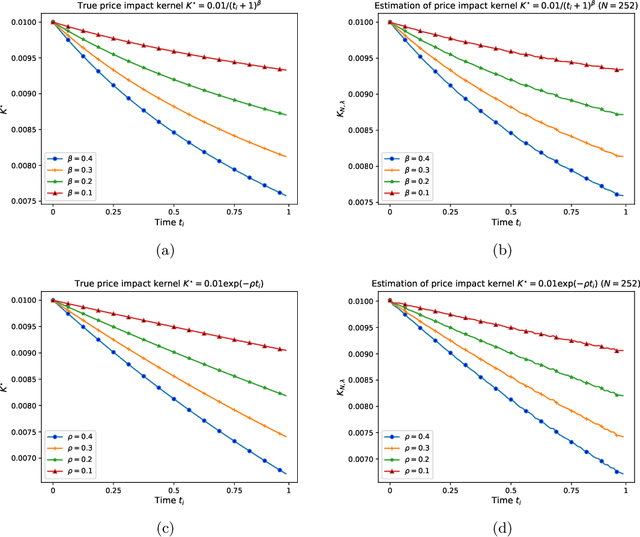

We consider an offline learning problem for an agent who first estimates an unknown price impact kernel from a static dataset, and then designs strategies to liquidate a risky asset while creating transient price impact. We propose a novel approach for a nonparametric estimation of the propagator from a dataset containing correlated price trajectories, trading signals and metaorders. We quantify the accuracy of the estimated propagator using a metric which depends explicitly on the dataset. We show that a trader who tries to minimise her execution costs by using a greedy strategy purely based on the estimated propagator will encounter suboptimality due to so-called spurious correlation between the trading strategy and the estimator and due to intrinsic uncertainty resulting from a biased cost functional. By adopting an offline reinforcement learning approach, we introduce a pessimistic loss functional taking the uncertainty of the estimated propagator into account, with an optimiser which eliminates the spurious correlation, and derive an asymptotically optimal bound on the execution costs even without precise information on the true propagator. Numerical experiments are included to demonstrate the effectiveness of the proposed propagator estimator and the pessimistic trading strategy.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge