A Scalable and Adaptive System to Infer the Industry Sectors of Companies: Prompt + Model Tuning of Generative Language Models

Paper and Code

Jun 05, 2023

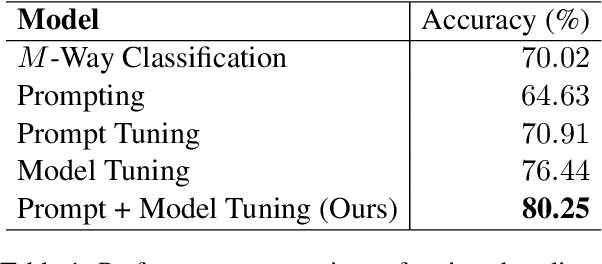

The Private Equity (PE) firms operate investment funds by acquiring and managing companies to achieve a high return upon selling. Many PE funds are thematic, meaning investment professionals aim to identify trends by covering as many industry sectors as possible, and picking promising companies within these sectors. So, inferring sectors for companies is critical to the success of thematic PE funds. In this work, we standardize the sector framework and discuss the typical challenges; we then introduce our sector inference system addressing these challenges. Specifically, our system is built on a medium-sized generative language model, finetuned with a prompt + model tuning procedure. The deployed model demonstrates a superior performance than the common baselines. The system has been serving many PE professionals for over a year, showing great scalability to data volume and adaptability to any change in sector framework and/or annotation.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge