A Multi-criteria Approach to Evolve Sparse Neural Architectures for Stock Market Forecasting

Paper and Code

Nov 15, 2021

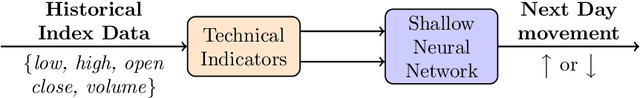

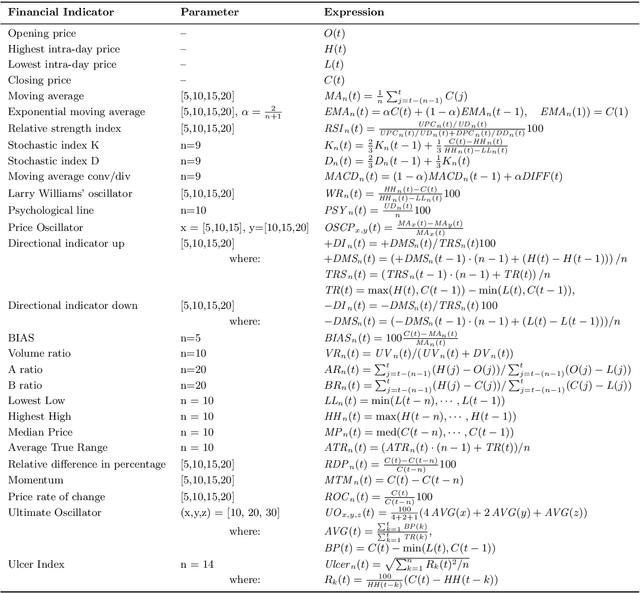

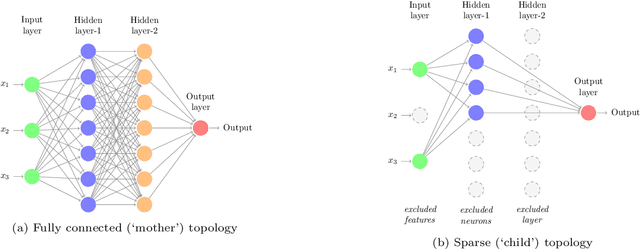

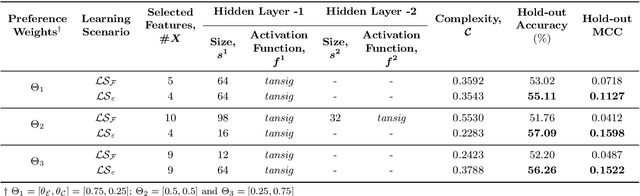

This study proposes a new framework to evolve efficacious yet parsimonious neural architectures for the movement prediction of stock market indices using technical indicators as inputs. In the light of a sparse signal-to-noise ratio under the Efficient Market hypothesis, developing machine learning methods to predict the movement of a financial market using technical indicators has shown to be a challenging problem. To this end, the neural architecture search is posed as a multi-criteria optimization problem to balance the efficacy with the complexity of architectures. In addition, the implications of different dominant trading tendencies which may be present in the pre-COVID and within-COVID time periods are investigated. An $\epsilon-$ constraint framework is proposed as a remedy to extract any concordant information underlying the possibly conflicting pre-COVID data. Further, a new search paradigm, Two-Dimensional Swarms (2DS) is proposed for the multi-criteria neural architecture search, which explicitly integrates sparsity as an additional search dimension in particle swarms. A detailed comparative evaluation of the proposed approach is carried out by considering genetic algorithm and several combinations of empirical neural design rules with a filter-based feature selection method (mRMR) as baseline approaches. The results of this study convincingly demonstrate that the proposed approach can evolve parsimonious networks with better generalization capabilities.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge