A machine learning workflow to address credit default prediction

Paper and Code

Mar 06, 2024

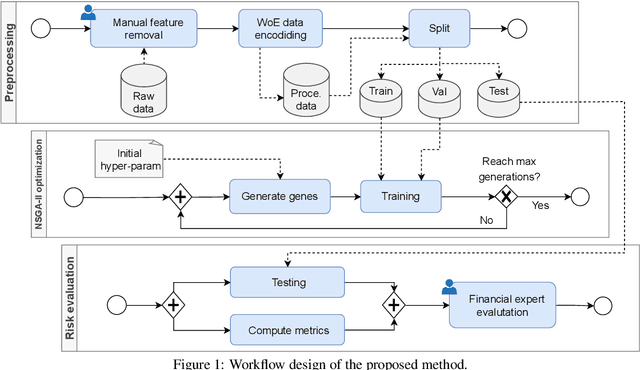

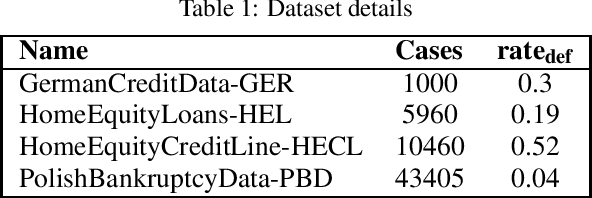

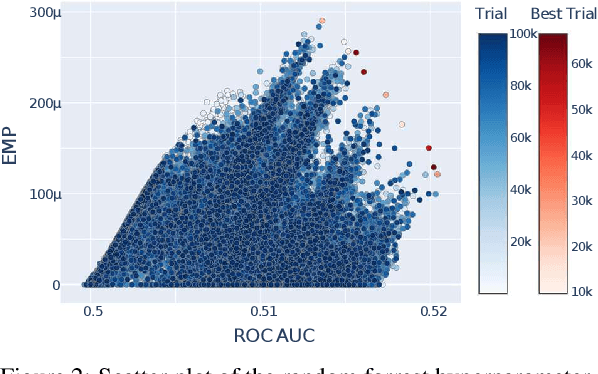

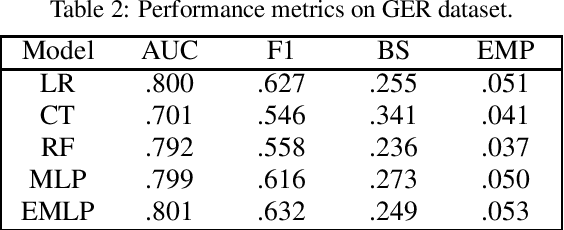

Due to the recent increase in interest in Financial Technology (FinTech), applications like credit default prediction (CDP) are gaining significant industrial and academic attention. In this regard, CDP plays a crucial role in assessing the creditworthiness of individuals and businesses, enabling lenders to make informed decisions regarding loan approvals and risk management. In this paper, we propose a workflow-based approach to improve CDP, which refers to the task of assessing the probability that a borrower will default on his or her credit obligations. The workflow consists of multiple steps, each designed to leverage the strengths of different techniques featured in machine learning pipelines and, thus best solve the CDP task. We employ a comprehensive and systematic approach starting with data preprocessing using Weight of Evidence encoding, a technique that ensures in a single-shot data scaling by removing outliers, handling missing values, and making data uniform for models working with different data types. Next, we train several families of learning models, introducing ensemble techniques to build more robust models and hyperparameter optimization via multi-objective genetic algorithms to consider both predictive accuracy and financial aspects. Our research aims at contributing to the FinTech industry in providing a tool to move toward more accurate and reliable credit risk assessment, benefiting both lenders and borrowers.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge