A Direct Estimation of High Dimensional Stationary Vector Autoregressions

Paper and Code

Oct 29, 2014

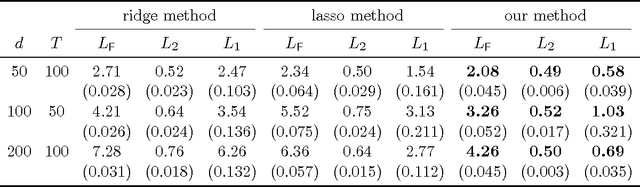

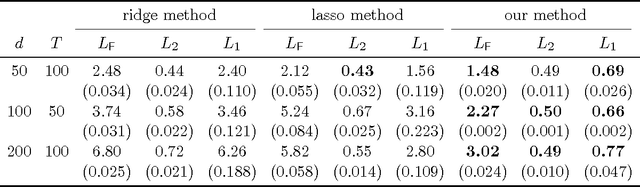

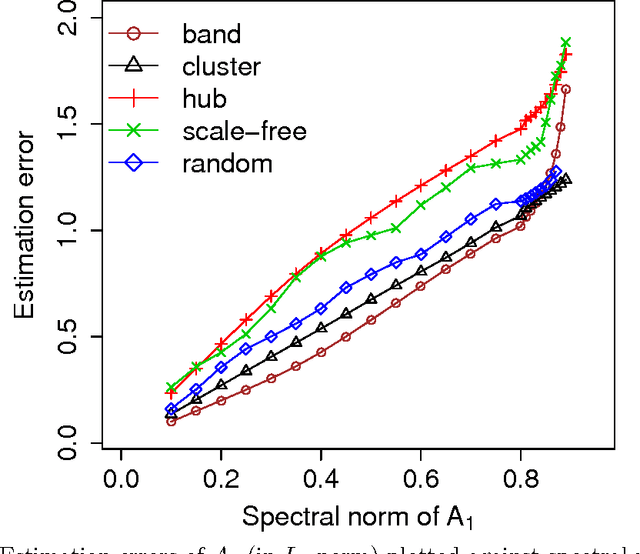

The vector autoregressive (VAR) model is a powerful tool in modeling complex time series and has been exploited in many fields. However, fitting high dimensional VAR model poses some unique challenges: On one hand, the dimensionality, caused by modeling a large number of time series and higher order autoregressive processes, is usually much higher than the time series length; On the other hand, the temporal dependence structure in the VAR model gives rise to extra theoretical challenges. In high dimensions, one popular approach is to assume the transition matrix is sparse and fit the VAR model using the "least squares" method with a lasso-type penalty. In this manuscript, we propose an alternative way in estimating the VAR model. The main idea is, via exploiting the temporal dependence structure, to formulate the estimating problem into a linear program. There is instant advantage for the proposed approach over the lasso-type estimators: The estimation equation can be decomposed into multiple sub-equations and accordingly can be efficiently solved in a parallel fashion. In addition, our method brings new theoretical insights into the VAR model analysis. So far the theoretical results developed in high dimensions (e.g., Song and Bickel (2011) and Kock and Callot (2012)) mainly pose assumptions on the design matrix of the formulated regression problems. Such conditions are indirect about the transition matrices and not transparent. In contrast, our results show that the operator norm of the transition matrices plays an important role in estimation accuracy. We provide explicit rates of convergence for both estimation and prediction. In addition, we provide thorough experiments on both synthetic and real-world equity data to show that there are empirical advantages of our method over the lasso-type estimators in both parameter estimation and forecasting.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge