A Comparison of Multi-View Learning Strategies for Satellite Image-Based Real Estate Appraisal

Paper and Code

May 11, 2021

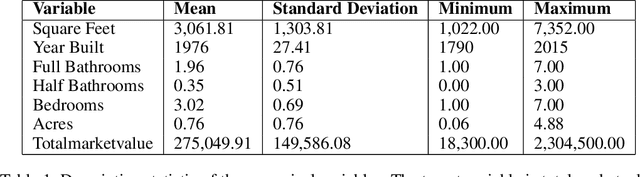

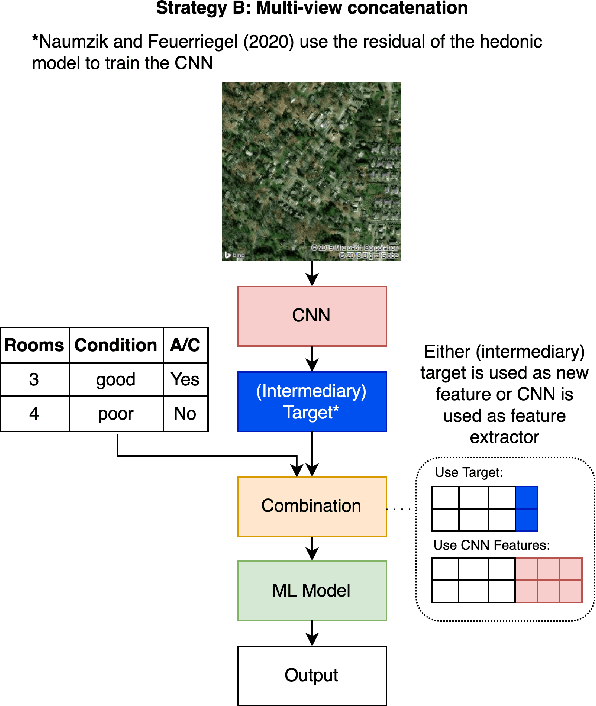

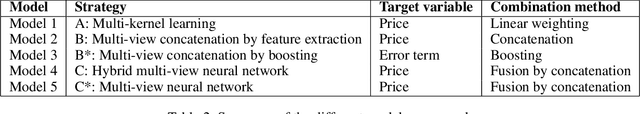

In the house credit process, banks and lenders rely on a fast and accurate estimation of a real estate price to determine the maximum loan value. Real estate appraisal is often based on relational data, capturing the hard facts of the property. Yet, models benefit strongly from including image data, capturing additional soft factors. The combination of the different data types requires a multi-view learning method. Therefore, the question arises which strengths and weaknesses different multi-view learning strategies have. In our study, we test multi-kernel learning, multi-view concatenation and multi-view neural networks on real estate data and satellite images from Asheville, NC. Our results suggest that multi-view learning increases the predictive performance up to 13% in MAE. Multi-view neural networks perform best, however result in intransparent black-box models. For users seeking interpretability, hybrid multi-view neural networks or a boosting strategy are a suitable alternative.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge