Yunjia Zhang

AnyAccomp: Generalizable Accompaniment Generation via Quantized Melodic Bottleneck

Sep 17, 2025

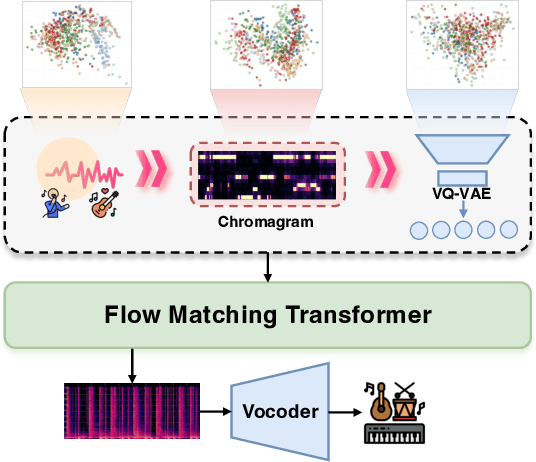

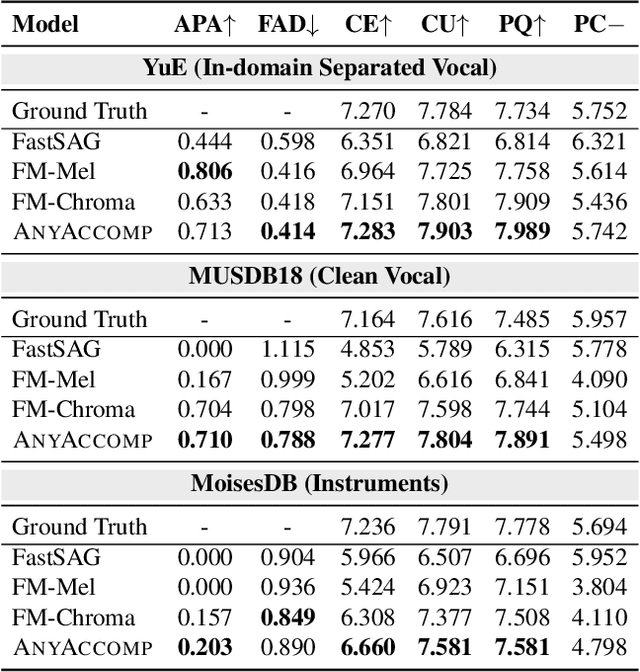

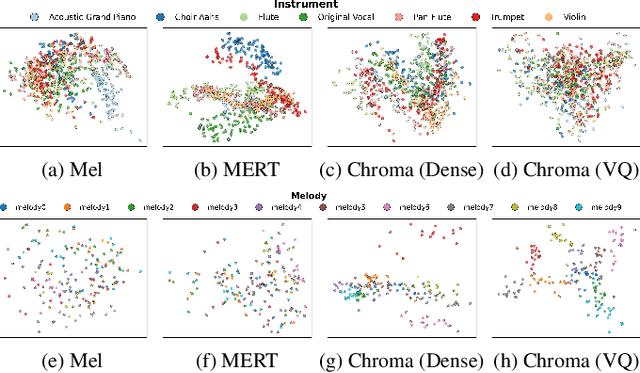

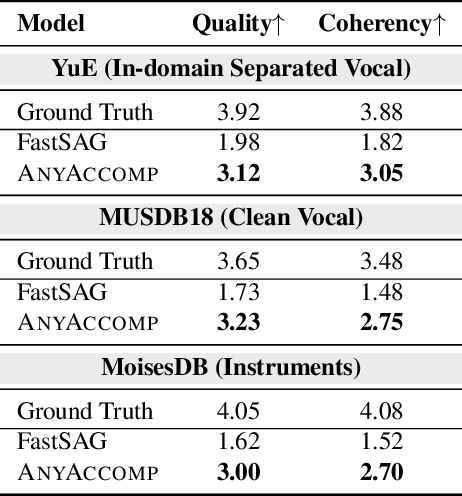

Abstract:Singing Accompaniment Generation (SAG) is the process of generating instrumental music for a given clean vocal input. However, existing SAG techniques use source-separated vocals as input and overfit to separation artifacts. This creates a critical train-test mismatch, leading to failure on clean, real-world vocal inputs. We introduce AnyAccomp, a framework that resolves this by decoupling accompaniment generation from source-dependent artifacts. AnyAccomp first employs a quantized melodic bottleneck, using a chromagram and a VQ-VAE to extract a discrete and timbre-invariant representation of the core melody. A subsequent flow-matching model then generates the accompaniment conditioned on these robust codes. Experiments show AnyAccomp achieves competitive performance on separated-vocal benchmarks while significantly outperforming baselines on generalization test sets of clean studio vocals and, notably, solo instrumental tracks. This demonstrates a qualitative leap in generalization, enabling robust accompaniment for instruments - a task where existing models completely fail - and paving the way for more versatile music co-creation tools. Demo audio and code: https://anyaccomp.github.io

LimiX: Unleashing Structured-Data Modeling Capability for Generalist Intelligence

Sep 03, 2025

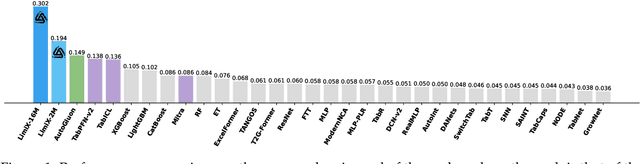

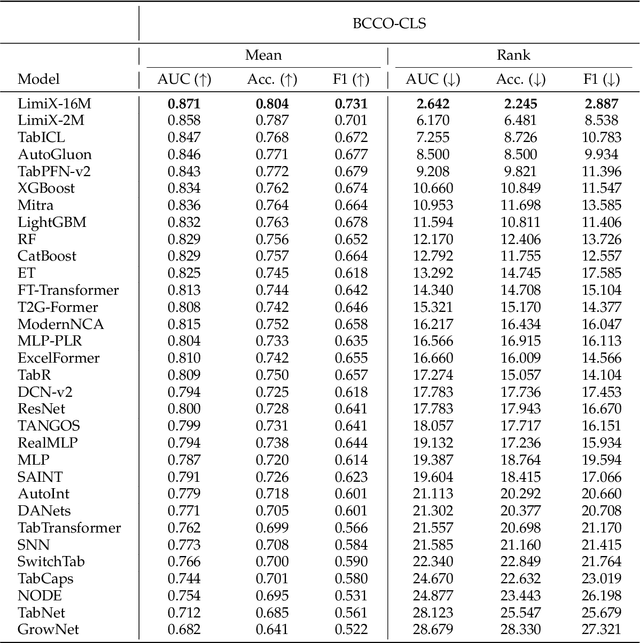

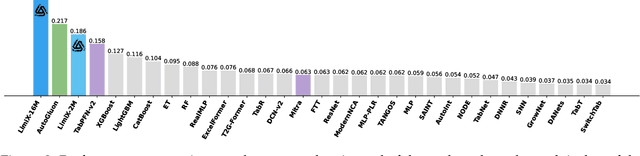

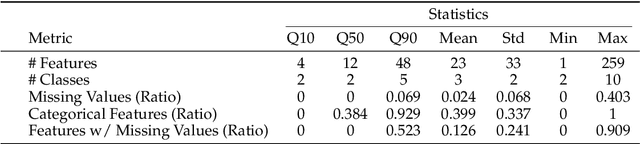

Abstract:We argue that progress toward general intelligence requires complementary foundation models grounded in language, the physical world, and structured data. This report presents LimiX, the first installment of our large structured-data models (LDMs). LimiX treats structured data as a joint distribution over variables and missingness, thus capable of addressing a wide range of tabular tasks through query-based conditional prediction via a single model. LimiX is pretrained using masked joint-distribution modeling with an episodic, context-conditional objective, where the model predicts for query subsets conditioned on dataset-specific contexts, supporting rapid, training-free adaptation at inference. We evaluate LimiX across 10 large structured-data benchmarks with broad regimes of sample size, feature dimensionality, class number, categorical-to-numerical feature ratio, missingness, and sample-to-feature ratios. With a single model and a unified interface, LimiX consistently surpasses strong baselines including gradient-boosting trees, deep tabular networks, recent tabular foundation models, and automated ensembles, as shown in Figure 1 and Figure 2. The superiority holds across a wide range of tasks, such as classification, regression, missing value imputation, and data generation, often by substantial margins, while avoiding task-specific architectures or bespoke training per task. All LimiX models are publicly accessible under Apache 2.0.

A Decapod Robot with Rotary Bellows-Enclosed Soft Transmissions

Mar 10, 2025Abstract:Soft crawling robots exhibit efficient locomotion across various terrains and demonstrate robustness to diverse environmental conditions. Here, we propose a valveless soft-legged robot that integrates a pair of rotary bellows-enclosed soft transmission systems (R-BESTS). The proposed R-BESTS can directly transmit the servo rotation into leg swing motion. A timing belt controls the pair of R-BESTS to maintain synchronous rotation in opposite phases, realizing alternating tripod gaits of walking and turning. We explored several designs to understand the role of a reinforcement skeleton in twisting the R-BESTS' input bellows units. The bending sequences of the robot legs are controlled through structural design for the output bellows units. Finally, we demonstrate untethered locomotion with the soft robotic decapod. Experimental results show that our robot can walk at 1.75 centimeters per second (0.07 body length per second) for 90 min, turn with a 15-centimeter (0.6 BL) radius, carry a payload of 200 g, and adapt to different terrains.

A Tensor-Based Sub-Mode Coordinate Algorithm for Stock Prediction

May 21, 2018

Abstract:The investment on the stock market is prone to be affected by the Internet. For the purpose of improving the prediction accuracy, we propose a multi-task stock prediction model that not only considers the stock correlations but also supports multi-source data fusion. Our proposed model first utilizes tensor to integrate the multi-sourced data, including financial Web news, investors' sentiments extracted from the social network and some quantitative data on stocks. In this way, the intrinsic relationships among different information sources can be captured, and meanwhile, multi-sourced information can be complemented to solve the data sparsity problem. Secondly, we propose an improved sub-mode coordinate algorithm (SMC). SMC is based on the stock similarity, aiming to reduce the variance of their subspace in each dimension produced by the tensor decomposition. The algorithm is able to improve the quality of the input features, and thus improves the prediction accuracy. And the paper utilizes the Long Short-Term Memory (LSTM) neural network model to predict the stock fluctuation trends. Finally, the experiments on 78 A-share stocks in CSI 100 and thirteen popular HK stocks in the year 2015 and 2016 are conducted. The results demonstrate the improvement on the prediction accuracy and the effectiveness of the proposed model.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge