Xue Wen Tan

The Shape of Reasoning: Topological Analysis of Reasoning Traces in Large Language Models

Oct 23, 2025Abstract:Evaluating the quality of reasoning traces from large language models remains understudied, labor-intensive, and unreliable: current practice relies on expert rubrics, manual annotation, and slow pairwise judgments. Automated efforts are dominated by graph-based proxies that quantify structural connectivity but do not clarify what constitutes high-quality reasoning; such abstractions can be overly simplistic for inherently complex processes. We introduce a topological data analysis (TDA)-based evaluation framework that captures the geometry of reasoning traces and enables label-efficient, automated assessment. In our empirical study, topological features yield substantially higher predictive power for assessing reasoning quality than standard graph metrics, suggesting that effective reasoning is better captured by higher-dimensional geometric structures rather than purely relational graphs. We further show that a compact, stable set of topological features reliably indicates trace quality, offering a practical signal for future reinforcement learning algorithms.

SMARTe: Slot-based Method for Accountable Relational Triple extraction

Apr 17, 2025

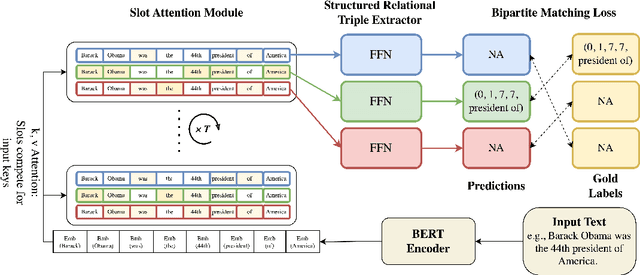

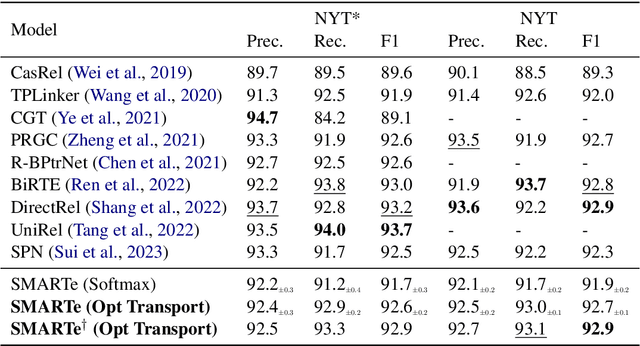

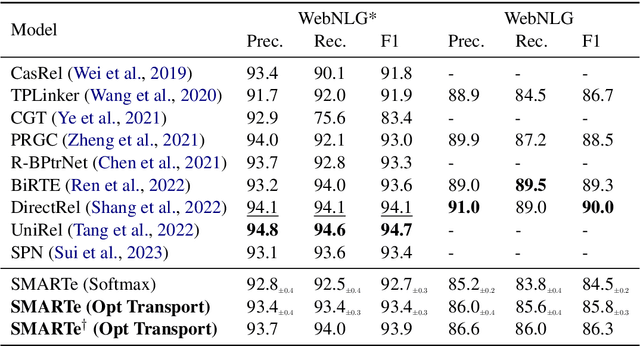

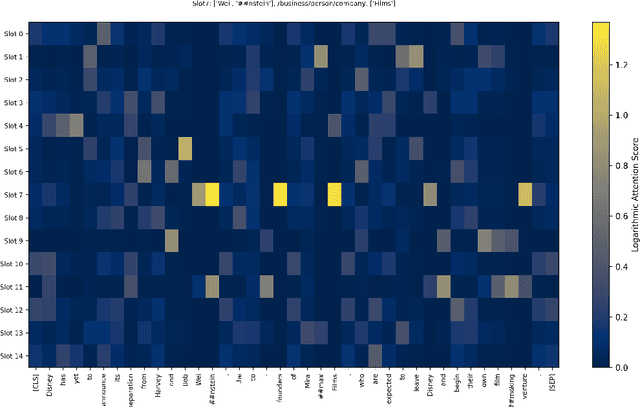

Abstract:Relational Triple Extraction (RTE) is a fundamental task in Natural Language Processing (NLP). However, prior research has primarily focused on optimizing model performance, with limited efforts to understand the internal mechanisms driving these models. Many existing methods rely on complex preprocessing to induce specific interactions, often resulting in opaque systems that may not fully align with their theoretical foundations. To address these limitations, we propose SMARTe: a Slot-based Method for Accountable Relational Triple extraction. SMARTe introduces intrinsic interpretability through a slot attention mechanism and frames the task as a set prediction problem. Slot attention consolidates relevant information into distinct slots, ensuring all predictions can be explicitly traced to learned slot representations and the tokens contributing to each predicted relational triple. While emphasizing interpretability, SMARTe achieves performance comparable to state-of-the-art models. Evaluations on the NYT and WebNLG datasets demonstrate that adding interpretability does not compromise performance. Furthermore, we conducted qualitative assessments to showcase the explanations provided by SMARTe, using attention heatmaps that map to their respective tokens. We conclude with a discussion of our findings and propose directions for future research.

Explainable Risk Classification in Financial Reports

May 06, 2024

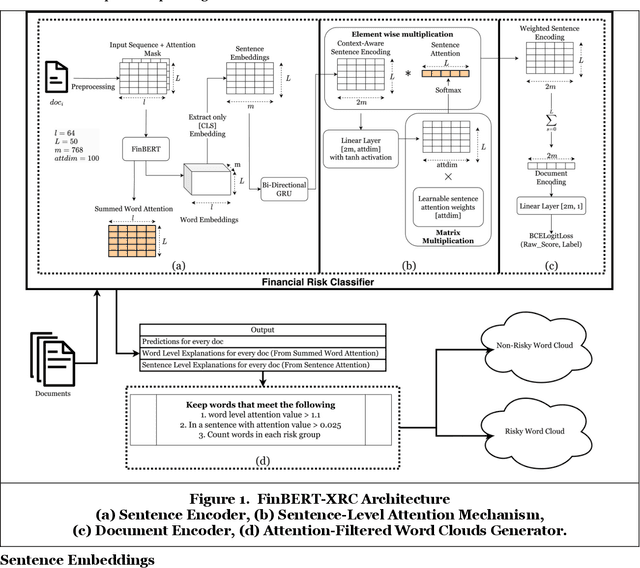

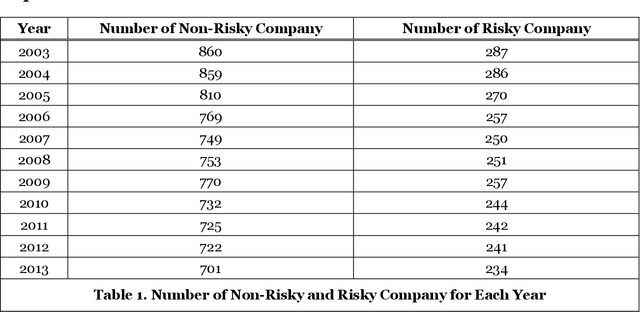

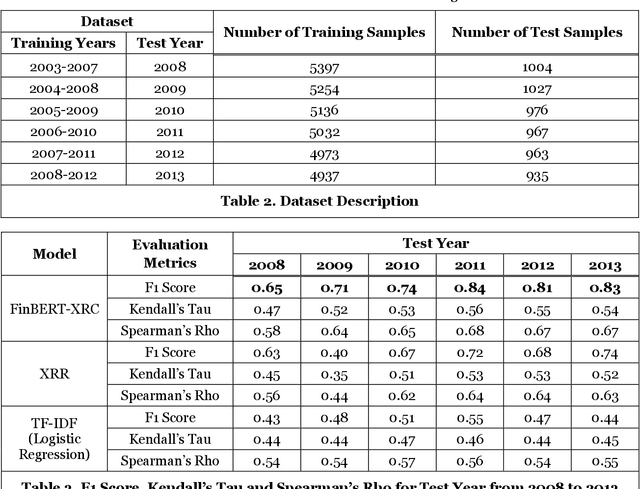

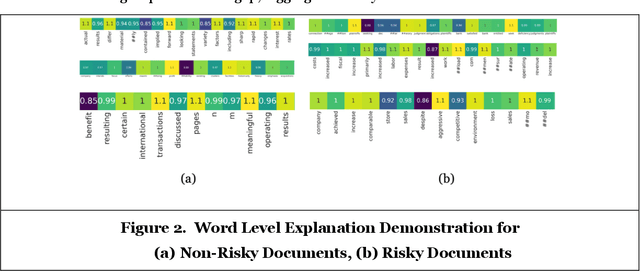

Abstract:Every publicly traded company in the US is required to file an annual 10-K financial report, which contains a wealth of information about the company. In this paper, we propose an explainable deep-learning model, called FinBERT-XRC, that takes a 10-K report as input, and automatically assesses the post-event return volatility risk of its associated company. In contrast to previous systems, our proposed model simultaneously offers explanations of its classification decision at three different levels: the word, sentence, and corpus levels. By doing so, our model provides a comprehensive interpretation of its prediction to end users. This is particularly important in financial domains, where the transparency and accountability of algorithmic predictions play a vital role in their application to decision-making processes. Aside from its novel interpretability, our model surpasses the state of the art in predictive accuracy in experiments on a large real-world dataset of 10-K reports spanning six years.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge