Trang-Thi Ho

DPCOVID: Privacy-Preserving Federated Covid-19 Detection

Oct 26, 2021

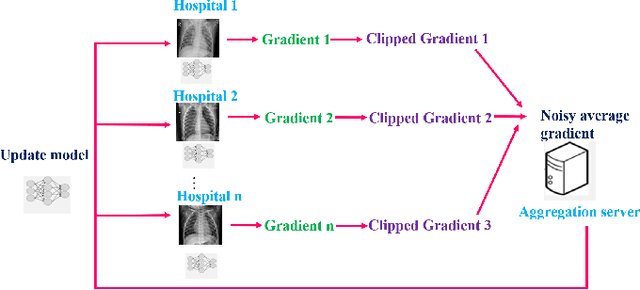

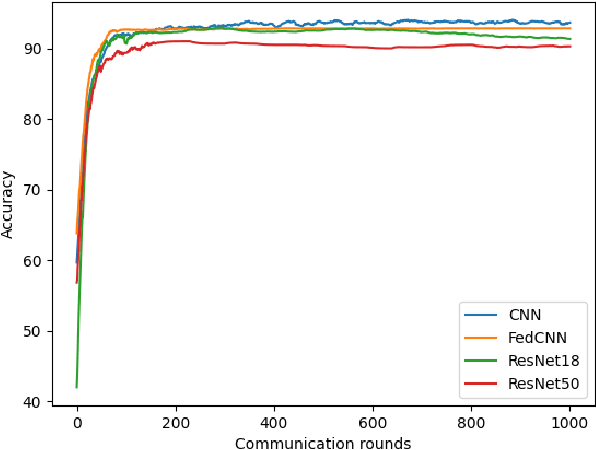

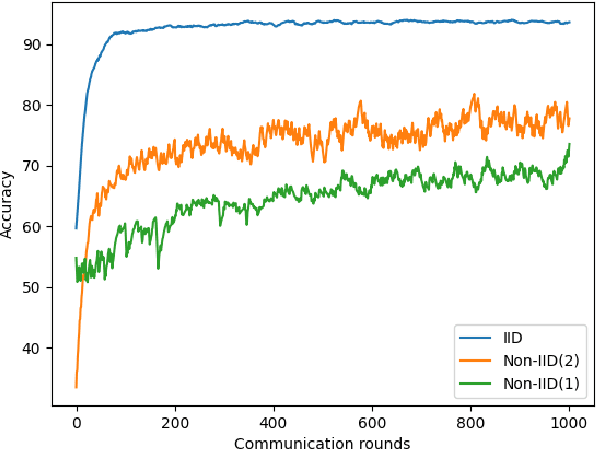

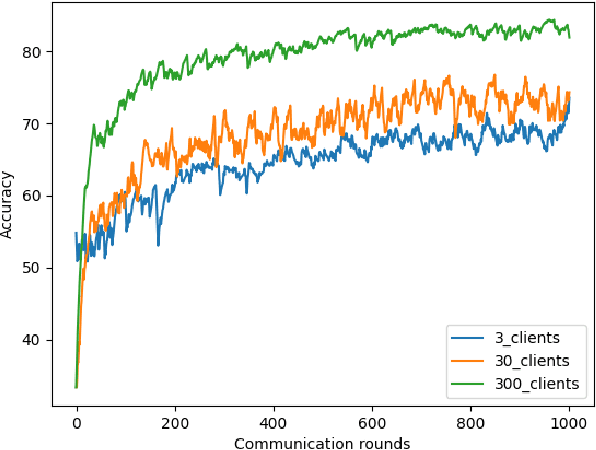

Abstract:Coronavirus (COVID-19) has shown an unprecedented global crisis by the detrimental effect on the global economy and health. The number of COVID-19 cases has been rapidly increasing, and there is no sign of stopping. It leads to a severe shortage of test kits and accurate detection models. A recent study demonstrated that the chest X-ray radiography outperformed laboratory testing in COVID-19 detection. Therefore, using chest X-ray radiography analysis can help to screen suspected COVID-19 cases at an early stage. Moreover, the patient data is sensitive, and it must be protected to avoid revealing through model updates and reconstruction from the malicious attacker. In this paper, we present a privacy-preserving Federated Learning system for COVID-19 detection based on chest X-ray images. First, a Federated Learning system is constructed from chest X-ray images. The main idea is to build a decentralized model across multiple hospitals without sharing data among hospitals. Second, we first show that the accuracy of Federated Learning for COVID-19 identification reduces significantly for Non-IID data. We then propose a strategy to improve model's accuracy on Non-IID COVID-19 data by increasing the total number of clients, parallelism (client fraction), and computation per client. Finally, we apply a Differential Privacy Stochastic Gradient Descent (DP-SGD) to enhance the preserving of patient data privacy for our Federated Learning model. A strategy is also proposed to keep the robustness of Federated Learning to ensure the security and accuracy of the model.

Using Deep Learning Neural Networks and Candlestick Chart Representation to Predict Stock Market

Feb 26, 2019

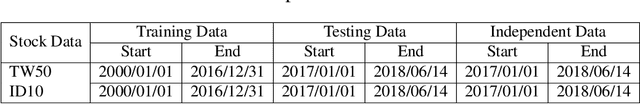

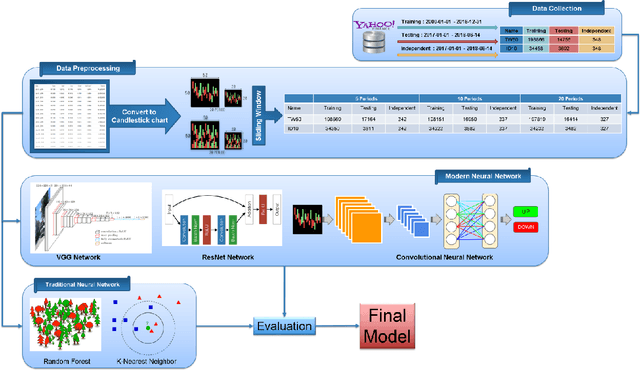

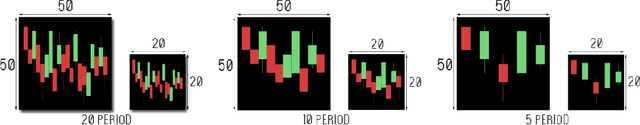

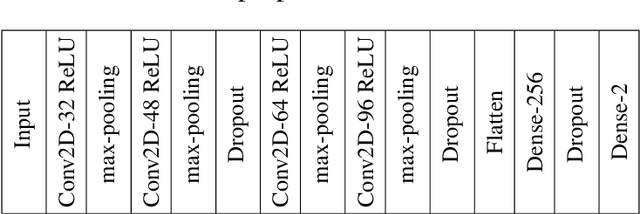

Abstract:Stock market prediction is still a challenging problem because there are many factors effect to the stock market price such as company news and performance, industry performance, investor sentiment, social media sentiment and economic factors. This work explores the predictability in the stock market using Deep Convolutional Network and candlestick charts. The outcome is utilized to design a decision support framework that can be used by traders to provide suggested indications of future stock price direction. We perform this work using various types of neural networks like convolutional neural network, residual network and visual geometry group network. From stock market historical data, we converted it to candlestick charts. Finally, these candlestick charts will be feed as input for training a Convolutional Neural Network model. This Convolutional Neural Network model will help us to analyze the patterns inside the candlestick chart and predict the future movements of stock market. The effectiveness of our method is evaluated in stock market prediction with a promising results 92.2% and 92.1% accuracy for Taiwan and Indonesian stock market dataset respectively. The constructed model have been implemented as a web-based system freely available at http://140.138.155.216/deepcandle/ for predicting stock market using candlestick chart and deep learning neural networks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge