Shima Nabiee

Stock Trend Prediction: A Semantic Segmentation Approach

Mar 09, 2023

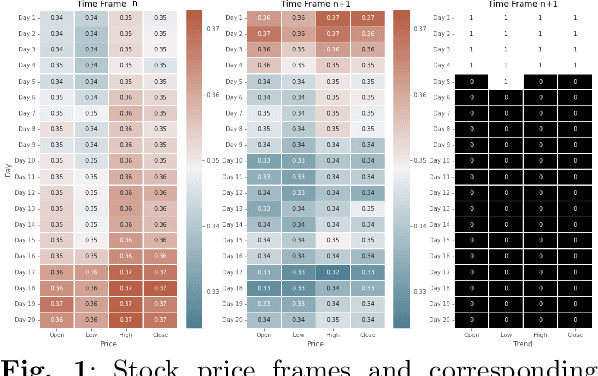

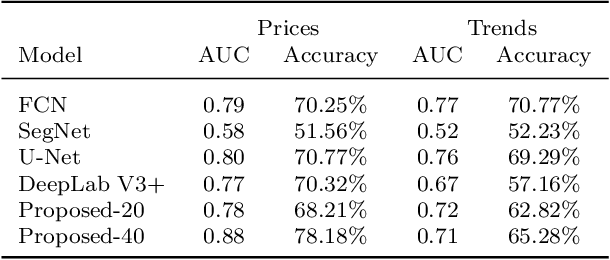

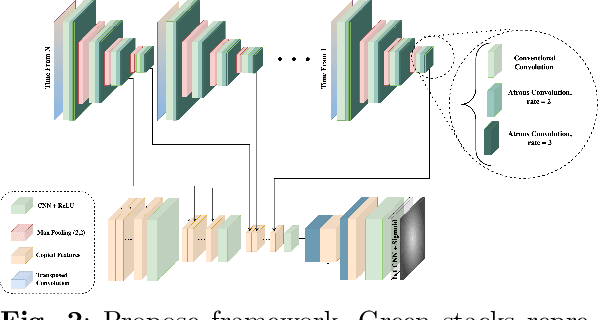

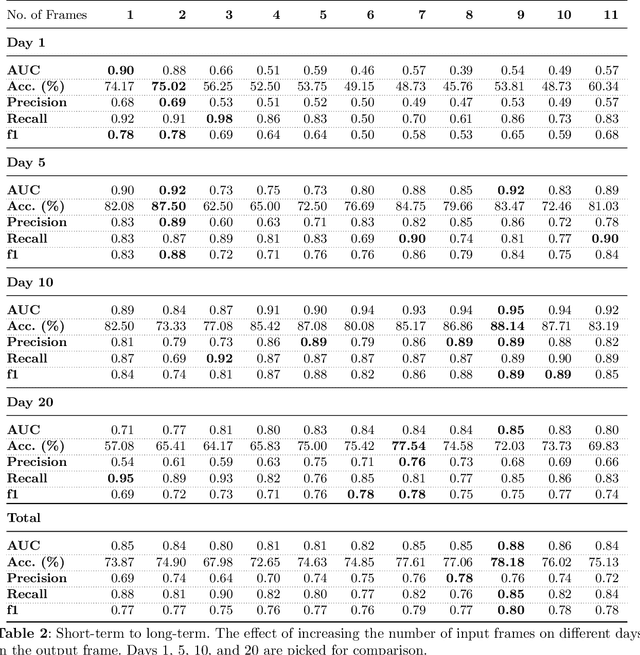

Abstract:Market financial forecasting is a trending area in deep learning. Deep learning models are capable of tackling the classic challenges in stock market data, such as its extremely complicated dynamics as well as long-term temporal correlation. To capture the temporal relationship among these time series, recurrent neural networks are employed. However, it is difficult for recurrent models to learn to keep track of long-term information. Convolutional Neural Networks have been utilized to better capture the dynamics and extract features for both short- and long-term forecasting. However, semantic segmentation and its well-designed fully convolutional networks have never been studied for time-series dense classification. We present a novel approach to predict long-term daily stock price change trends with fully 2D-convolutional encoder-decoders. We generate input frames with daily prices for a time-frame of T days. The aim is to predict future trends by pixel-wise classification of the current price frame. We propose a hierarchical CNN structure to encode multiple price frames to multiscale latent representation in parallel using Atrous Spatial Pyramid Pooling blocks and take that temporal coarse feature stacks into account in the decoding stages. Our hierarchical structure of CNNs makes it capable of capturing both long and short-term temporal relationships effectively. The effect of increasing the input time horizon via incrementing parallel encoders has been studied with interesting and substantial changes in the output segmentation masks. We achieve overall accuracy and AUC of %78.18 and 0.88 for joint trend prediction over the next 20 days, surpassing other semantic segmentation approaches. We compared our proposed model with several deep models specifically designed for technical analysis and found that for different output horizons, our proposed models outperformed other models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge