Petr Sokerin

Concealed Adversarial attacks on neural networks for sequential data

Feb 28, 2025

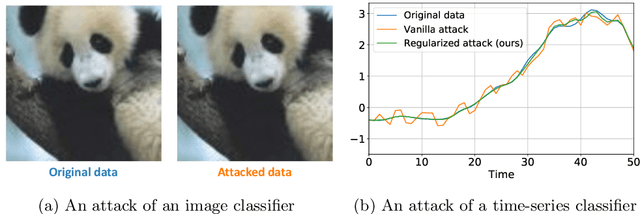

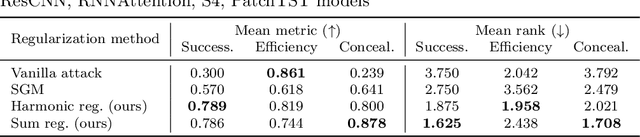

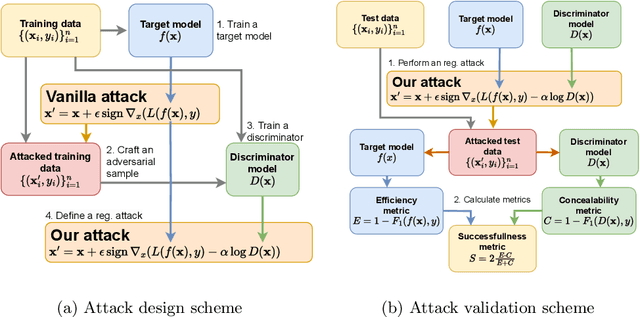

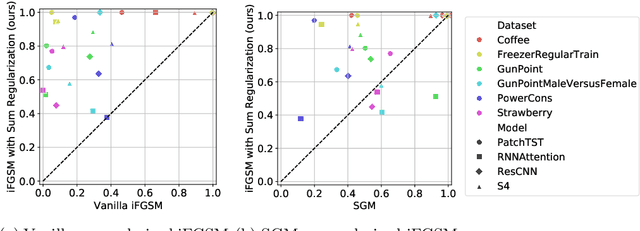

Abstract:The emergence of deep learning led to the broad usage of neural networks in the time series domain for various applications, including finance and medicine. While powerful, these models are prone to adversarial attacks: a benign targeted perturbation of input data leads to significant changes in a classifier's output. However, formally small attacks in the time series domain become easily detected by the human eye or a simple detector model. We develop a concealed adversarial attack for different time-series models: it provides more realistic perturbations, being hard to detect by a human or model discriminator. To achieve this goal, the proposed adversarial attack maximizes an aggregation of a classifier and a trained discriminator loss. To make the attack stronger, we also propose a training procedure for a discriminator that provides broader coverage of possible attacks. Extensive benchmarking on six UCR time series datasets across four diverse architectures - including recurrent, convolutional, state-space, and transformer-based models - demonstrates the superiority of our attack for a concealability-efficiency trade-off. Our findings highlight the growing challenge of designing robust time series models, emphasizing the need for improved defenses against realistic and effective attacks.

Portfolio Selection via Topological Data Analysis

Aug 15, 2023Abstract:Portfolio management is an essential part of investment decision-making. However, traditional methods often fail to deliver reasonable performance. This problem stems from the inability of these methods to account for the unique characteristics of multivariate time series data from stock markets. We present a two-stage method for constructing an investment portfolio of common stocks. The method involves the generation of time series representations followed by their subsequent clustering. Our approach utilizes features based on Topological Data Analysis (TDA) for the generation of representations, allowing us to elucidate the topological structure within the data. Experimental results show that our proposed system outperforms other methods. This superior performance is consistent over different time frames, suggesting the viability of TDA as a powerful tool for portfolio selection.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge