Ondřej Hubáček

Beating the market with a bad predictive model

Oct 23, 2020

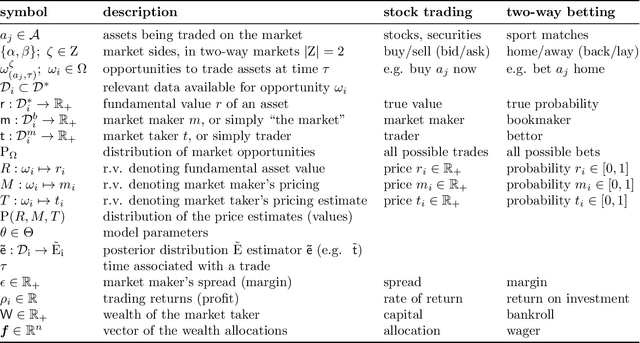

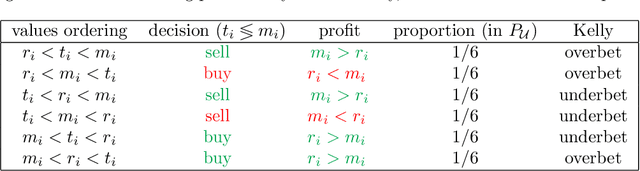

Abstract:It is a common misconception that in order to make consistent profits as a trader, one needs to posses some extra information leading to an asset value estimation more accurate than that reflected by the current market price. While the idea makes intuitive sense and is also well substantiated by the widely popular Kelly criterion, we prove that it is generally possible to make systematic profits with a completely inferior price-predicting model. The key idea is to alter the training objective of the predictive models to explicitly decorrelate them from the market, enabling to exploit inconspicuous biases in market maker's pricing, and profit on the inherent advantage of the market taker. We introduce the problem setting throughout the diverse domains of stock trading and sports betting to provide insights into the common underlying properties of profitable predictive models, their connections to standard portfolio optimization strategies, and the, commonly overlooked, advantage of the market taker. Consequently, we prove desirability of the decorrelation objective across common market distributions, translate the concept into a practical machine learning setting, and demonstrate its viability with real world market data.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge