Olamilekan Shobayo

Innovative Sentiment Analysis and Prediction of Stock Price Using FinBERT, GPT-4 and Logistic Regression: A Data-Driven Approach

Dec 07, 2024Abstract:This study explores the comparative performance of cutting-edge AI models, i.e., Finaance Bidirectional Encoder representations from Transsformers (FinBERT), Generatice Pre-trained Transformer GPT-4, and Logistic Regression, for sentiment analysis and stock index prediction using financial news and the NGX All-Share Index data label. By leveraging advanced natural language processing models like GPT-4 and FinBERT, alongside a traditional machine learning model, Logistic Regression, we aim to classify market sentiment, generate sentiment scores, and predict market price movements. This research highlights global AI advancements in stock markets, showcasing how state-of-the-art language models can contribute to understanding complex financial data. The models were assessed using metrics such as accuracy, precision, recall, F1 score, and ROC AUC. Results indicate that Logistic Regression outperformed the more computationally intensive FinBERT and predefined approach of versatile GPT-4, with an accuracy of 81.83% and a ROC AUC of 89.76%. The GPT-4 predefined approach exhibited a lower accuracy of 54.19% but demonstrated strong potential in handling complex data. FinBERT, while offering more sophisticated analysis, was resource-demanding and yielded a moderate performance. Hyperparameter optimization using Optuna and cross-validation techniques ensured the robustness of the models. This study highlights the strengths and limitations of the practical applications of AI approaches in stock market prediction and presents Logistic Regression as the most efficient model for this task, with FinBERT and GPT-4 representing emerging tools with potential for future exploration and innovation in AI-driven financial analytics

* 21 pages

GRUvader: Sentiment-Informed Stock Market Prediction

Dec 07, 2024

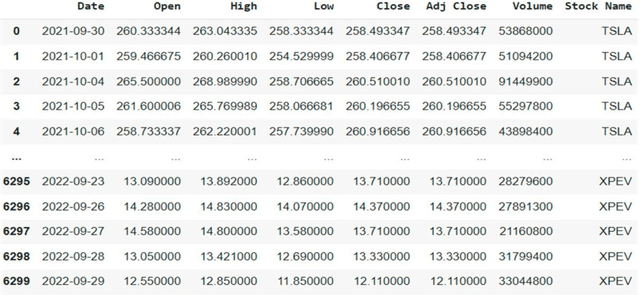

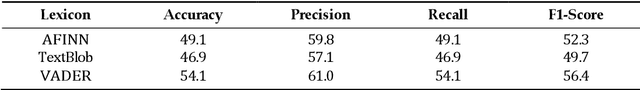

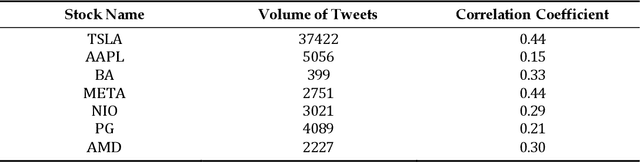

Abstract:Stock price prediction is challenging due to global economic instability, high volatility, and the complexity of financial markets. Hence, this study compared several machine learning algorithms for stock market prediction and further examined the influence of a sentiment analysis indicator on the prediction of stock prices. Our results were two-fold. Firstly, we used a lexicon-based sentiment analysis approach to identify sentiment features, thus evidencing the correlation between the sentiment indicator and stock price movement. Secondly, we proposed the use of GRUvader, an optimal gated recurrent unit network, for stock market prediction. Our findings suggest that stand-alone models struggled compared with AI-enhanced models. Thus, our paper makes further recommendations on latter systems.

* 18 pages

An Exploration of Clustering Algorithms for Customer Segmentation in the UK Retail Market

Feb 06, 2024Abstract:Recently, peoples awareness of online purchases has significantly risen. This has given rise to online retail platforms and the need for a better understanding of customer purchasing behaviour. Retail companies are pressed with the need to deal with a high volume of customer purchases, which requires sophisticated approaches to perform more accurate and efficient customer segmentation. Customer segmentation is a marketing analytical tool that aids customer-centric service and thus enhances profitability. In this paper, we aim to develop a customer segmentation model to improve decision-making processes in the retail market industry. To achieve this, we employed a UK-based online retail dataset obtained from the UCI machine learning repository. The retail dataset consists of 541,909 customer records and eight features. Our study adopted the RFM (recency, frequency, and monetary) framework to quantify customer values. Thereafter, we compared several state-of-the-art (SOTA) clustering algorithms, namely, K-means clustering, the Gaussian mixture model (GMM), density-based spatial clustering of applications with noise (DBSCAN), agglomerative clustering, and balanced iterative reducing and clustering using hierarchies (BIRCH). The results showed the GMM outperformed other approaches, with a Silhouette Score of 0.80.

* 15 pages, Journal of Analytics

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge