Massimo Riccaboni

Hierarchical Clustering and Matrix Completion for the Reconstruction of World Input-Output Tables

Mar 16, 2022

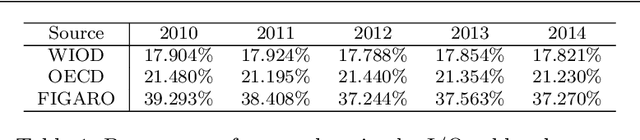

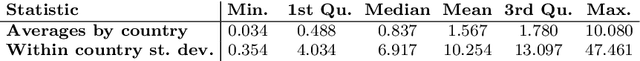

Abstract:World Input-Output (I/O) matrices provide the networks of within- and cross-country economic relations. In the context of I/O analysis, the methodology adopted by national statistical offices in data collection raises the issue of obtaining reliable data in a timely fashion and it makes the reconstruction of (part of) the I/O matrices of particular interest. In this work, we propose a method combining hierarchical clustering and Matrix Completion (MC) with a LASSO-like nuclear norm penalty, to impute missing entries of a partially unknown I/O matrix. Through simulations based on synthetic matrices we study the effectiveness of the proposed method to predict missing values from both previous years data and current data related to countries similar to the one for which current data are obscured. To show the usefulness of our method, an application based on World Input-Output Database (WIOD) tables - which are an example of industry-by-industry I/O tables - is provided. Strong similarities in structure between WIOD and other I/O tables are also found, which make the proposed approach easily generalizable to them.

Assessing the Impact of COVID-19 on Trade: a Machine Learning Counterfactual Analysis

Apr 09, 2021

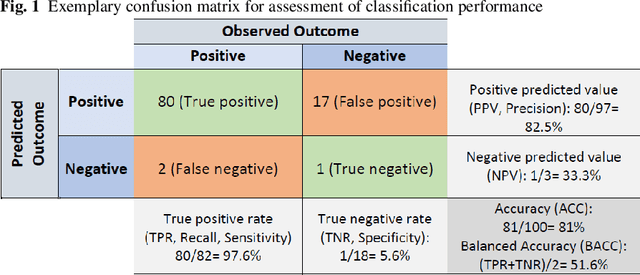

Abstract:By interpreting exporters' dynamics as a complex learning process, this paper constitutes the first attempt to investigate the effectiveness of different Machine Learning (ML) techniques in predicting firms' trade status. We focus on the probability of Colombian firms surviving in the export market under two different scenarios: a COVID-19 setting and a non-COVID-19 counterfactual situation. By comparing the resulting predictions, we estimate the individual treatment effect of the COVID-19 shock on firms' outcomes. Finally, we use recursive partitioning methods to identify subgroups with differential treatment effects. We find that, besides the temporal dimension, the main factors predicting treatment heterogeneity are interactions between firm size and industry.

Supervised learning for the prediction of firm dynamics

Sep 11, 2020

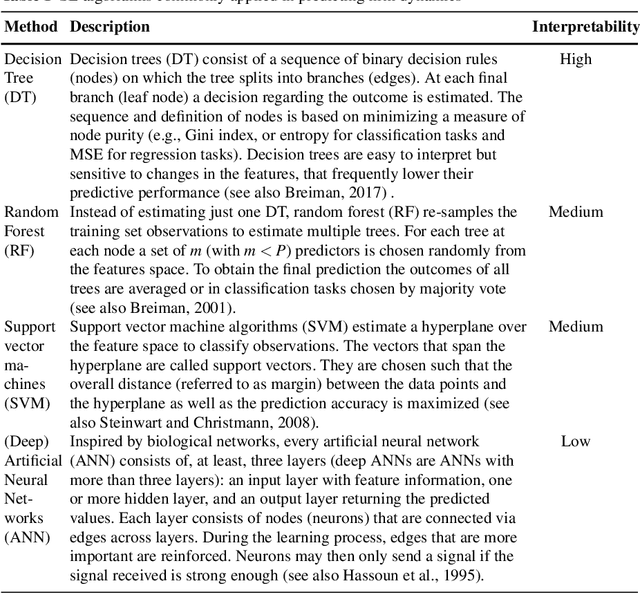

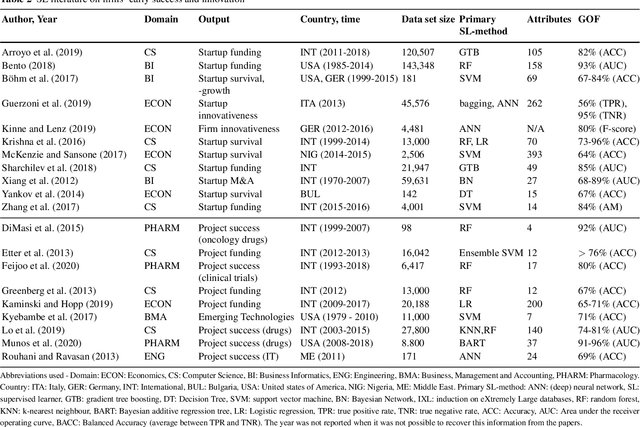

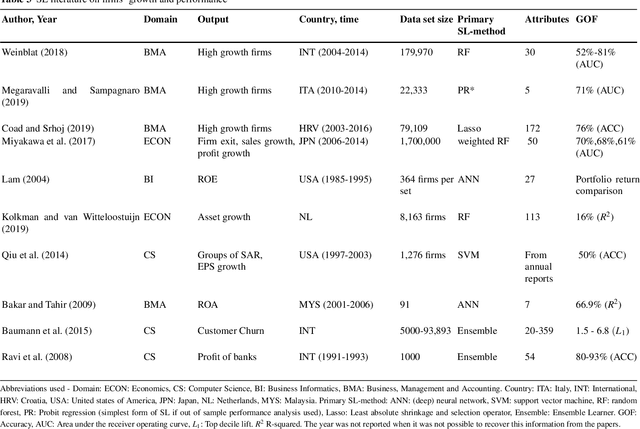

Abstract:Thanks to the increasing availability of granular, yet high-dimensional, firm level data, machine learning (ML) algorithms have been successfully applied to address multiple research questions related to firm dynamics. Especially supervised learning (SL), the branch of ML dealing with the prediction of labelled outcomes, has been used to better predict firms' performance. In this contribution, we will illustrate a series of SL approaches to be used for prediction tasks, relevant at different stages of the company life cycle. The stages we will focus on are (i) startup and innovation, (ii) growth and performance of companies, and (iii) firms exit from the market. First, we review SL implementations to predict successful startups and R&D projects. Next, we describe how SL tools can be used to analyze company growth and performance. Finally, we review SL applications to better forecast financial distress and company failure. In the concluding Section, we extend the discussion of SL methods in the light of targeted policies, result interpretability, and causality.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge