Maria Begicheva

Bank transactions embeddings help to uncover current macroeconomics

Oct 26, 2021

Abstract:Macroeconomic indexes are of high importance for banks: many risk-control decisions utilize these indexes. A typical workflow of these indexes evaluation is costly and protracted, with a lag between the actual date and available index being a couple of months. Banks predict such indexes now using autoregressive models to make decisions in a rapidly changing environment. However, autoregressive models fail in complex scenarios related to appearances of crises. We propose to use clients' financial transactions data from a large Russian bank to get such indexes. Financial transactions are long, and a number of clients is huge, so we develop an efficient approach that allows fast and accurate estimation of macroeconomic indexes based on a stream of transactions consisting of millions of transactions. The approach uses a neural networks paradigm and a smart sampling scheme. The results show that our neural network approach outperforms the baseline method on hand-crafted features based on transactions. Calculated embeddings show the correlation between the client's transaction activity and bank macroeconomic indexes over time.

MMDF: Mobile Microscopy Deep Framework

Jul 27, 2020

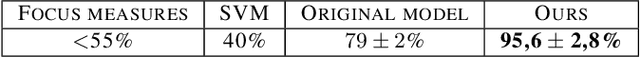

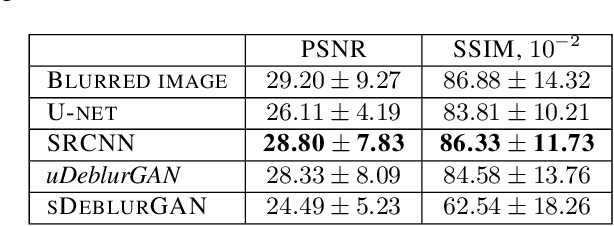

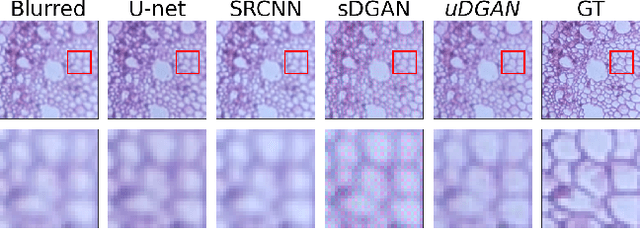

Abstract:In the last decade, a huge step was done in the field of mobile microscopes development as well as in the field of mobile microscopy application to real-life disease diagnostics and a lot of other important areas (air/water quality pollution, education, agriculture). In current study we applied image processing techniques from Deep Learning (in-focus/out-of-focus classification, image deblurring and denoising, multi-focus image fusion) to the data obtained from the mobile microscope. Overview of significant works for every task is presented, the most suitable approaches were highlighted. Chosen approaches were implemented as well as their performance were compared with classical computer vision techniques.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge