Jose M. Vidal

Learning in Multiagent Systems: An Introduction from a Game-Theoretic Perspective

Aug 19, 2003

Abstract:We introduce the topic of learning in multiagent systems. We first provide a quick introduction to the field of game theory, focusing on the equilibrium concepts of iterated dominance, and Nash equilibrium. We show some of the most relevant findings in the theory of learning in games, including theorems on fictitious play, replicator dynamics, and evolutionary stable strategies. The CLRI theory and n-level learning agents are introduced as attempts to apply some of these findings to the problem of engineering multiagent systems with learning agents. Finally, we summarize some of the remaining challenges in the field of learning in multiagent systems.

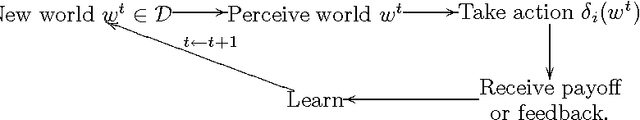

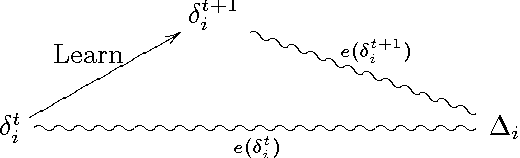

Predicting the expected behavior of agents that learn about agents: the CLRI framework

Jun 20, 2003

Abstract:We describe a framework and equations used to model and predict the behavior of multi-agent systems (MASs) with learning agents. A difference equation is used for calculating the progression of an agent's error in its decision function, thereby telling us how the agent is expected to fare in the MAS. The equation relies on parameters which capture the agent's learning abilities, such as its change rate, learning rate and retention rate, as well as relevant aspects of the MAS such as the impact that agents have on each other. We validate the framework with experimental results using reinforcement learning agents in a market system, as well as with other experimental results gathered from the AI literature. Finally, we use PAC-theory to show how to calculate bounds on the values of the learning parameters.

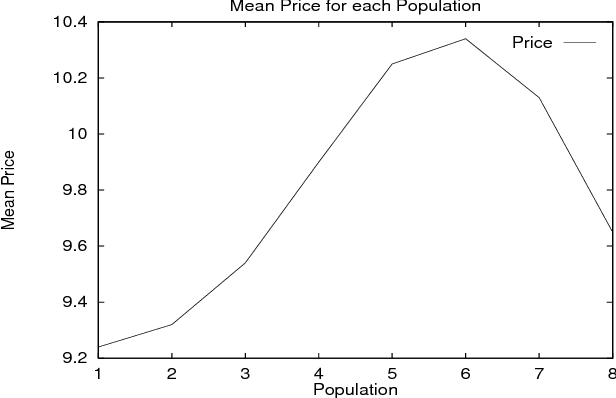

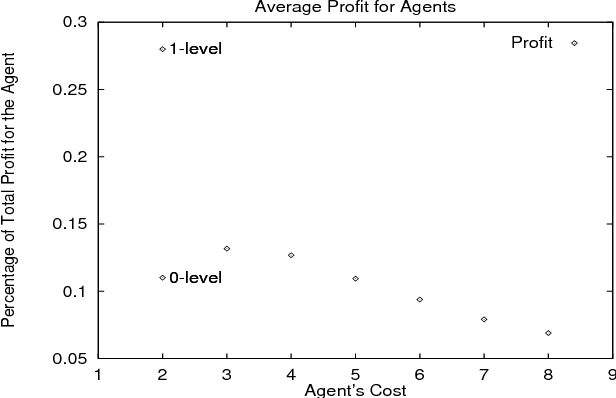

Learning Nested Agent Models in an Information Economy

Sep 26, 1998

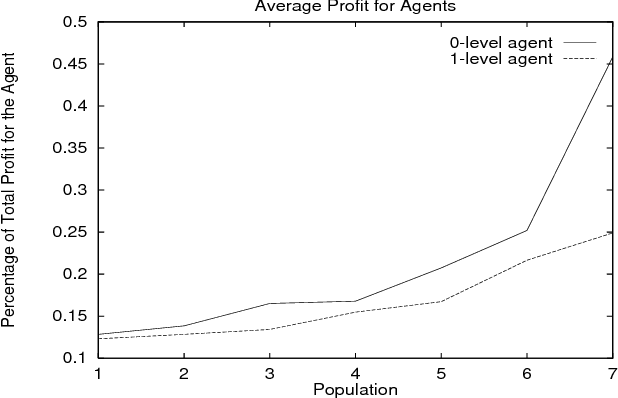

Abstract:We present our approach to the problem of how an agent, within an economic Multi-Agent System, can determine when it should behave strategically (i.e. learn and use models of other agents), and when it should act as a simple price-taker. We provide a framework for the incremental implementation of modeling capabilities in agents, and a description of the forms of knowledge required. The agents were implemented and different populations simulated in order to learn more about their behavior and the merits of using and learning agent models. Our results show, among other lessons, how savvy buyers can avoid being ``cheated'' by sellers, how price volatility can be used to quantitatively predict the benefits of deeper models, and how specific types of agent populations influence system behavior.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge