Giuseppe Carlo Calafiore

Aiding Global Convergence in Federated Learning via Local Perturbation and Mutual Similarity Information

Oct 07, 2024

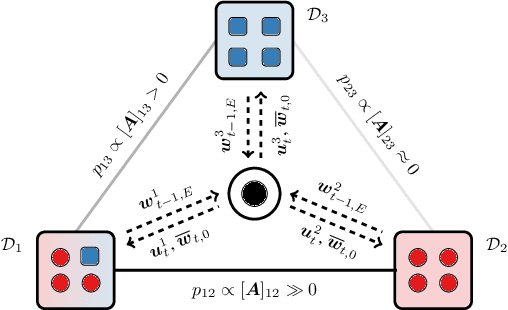

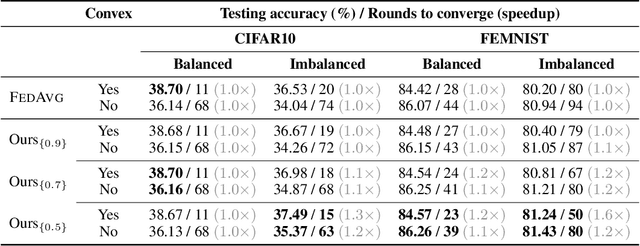

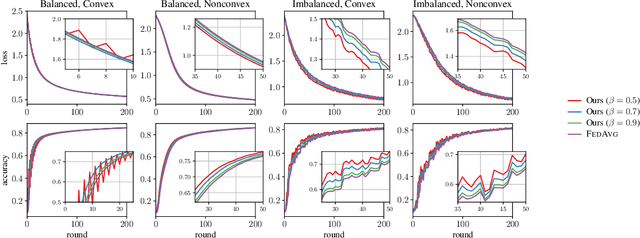

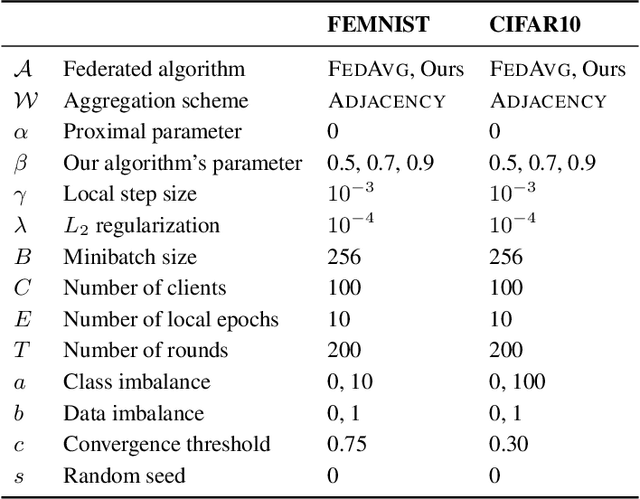

Abstract:Federated learning has emerged in the last decade as a distributed optimization paradigm due to the rapidly increasing number of portable devices able to support the heavy computational needs related to the training of machine learning models. Federated learning utilizes gradient-based optimization to minimize a loss objective shared across participating agents. To the best of our knowledge, the literature mostly lacks elegant solutions that naturally harness the reciprocal statistical similarity between clients to redesign the optimization procedure. To address this gap, by conceiving the federated network as a similarity graph, we propose a novel modified framework wherein each client locally performs a perturbed gradient step leveraging prior information about other statistically affine clients. We theoretically prove that our procedure, due to a suitably introduced adaptation in the update rule, achieves a quantifiable speedup concerning the exponential contraction factor in the strongly convex case compared with popular algorithms FedAvg and FedProx, here analyzed as baselines. Lastly, we legitimize our conclusions through experimental results on the CIFAR10 and FEMNIST datasets, where we show that our algorithm speeds convergence up to a margin of 30 global rounds compared with FedAvg while modestly improving generalization on unseen data in heterogeneous settings.

A Classifiers Voting Model for Exit Prediction of Privately Held Companies

Oct 30, 2019

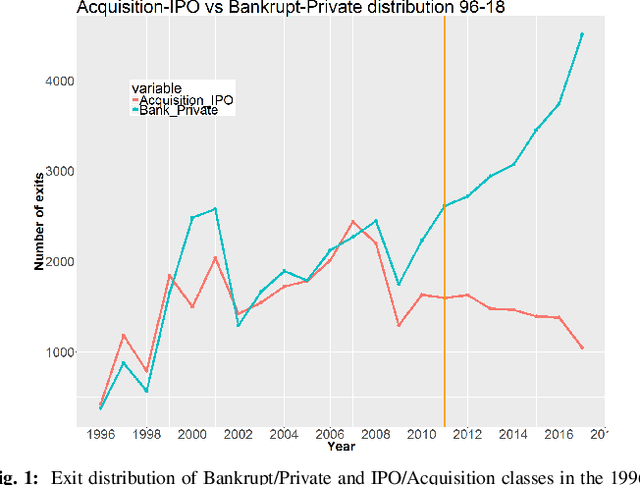

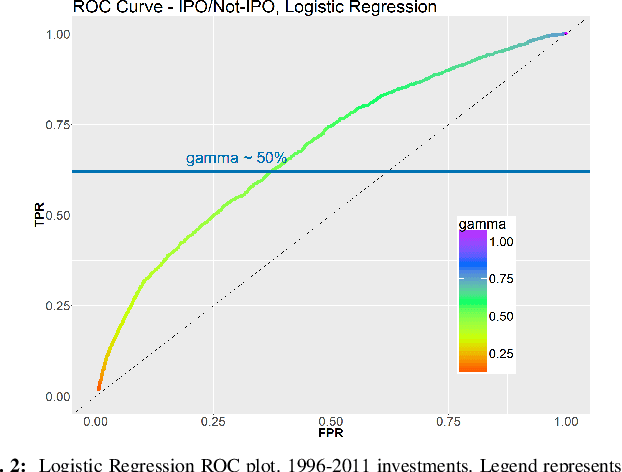

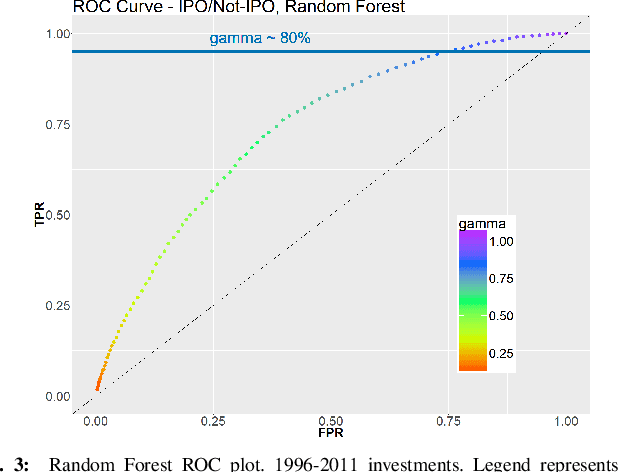

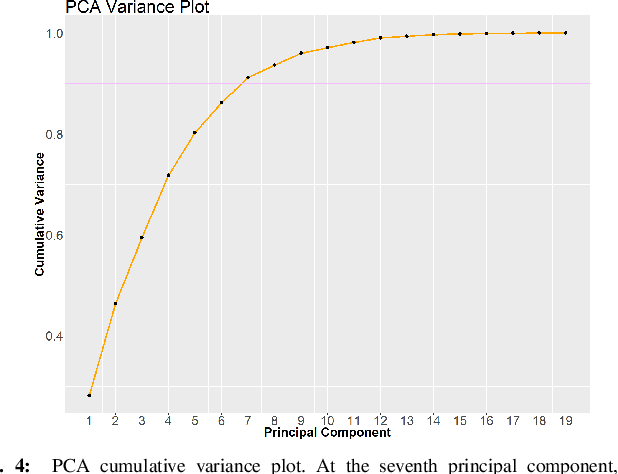

Abstract:Predicting the exit (e.g. bankrupt, acquisition, etc.) of privately held companies is a current and relevant problem for investment firms. The difficulty of the problem stems from the lack of reliable, quantitative and publicly available data. In this paper, we contribute to this endeavour by constructing an exit predictor model based on qualitative data, which blends the outcomes of three classifiers, namely, a Logistic Regression model, a Random Forest model, and a Support Vector Machine model. The output of the combined model is selected on the basis of the majority of the output classes of the component models. The models are trained using data extracted from the Thomson Reuters Eikon repository of 54697 US and European companies over the 1996-2011 time span. Experiments have been conducted for predicting whether the company eventually either gets acquired or goes public (IPO), against the complementary event that it remains private or goes bankrupt, in the considered time window. Our model achieves a 63\% predictive accuracy, which is quite a valuable figure for Private Equity investors, who typically expect very high returns from successful investments.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge