Derek Bunn

Forecasting the Intra-Day Spread Densities of Electricity Prices

Feb 20, 2020

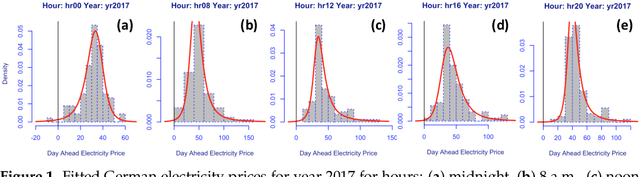

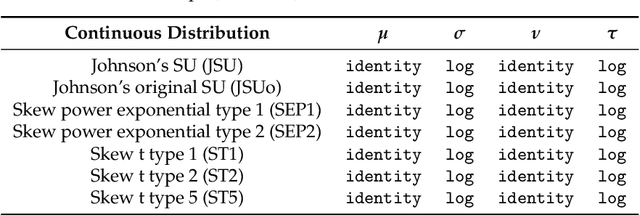

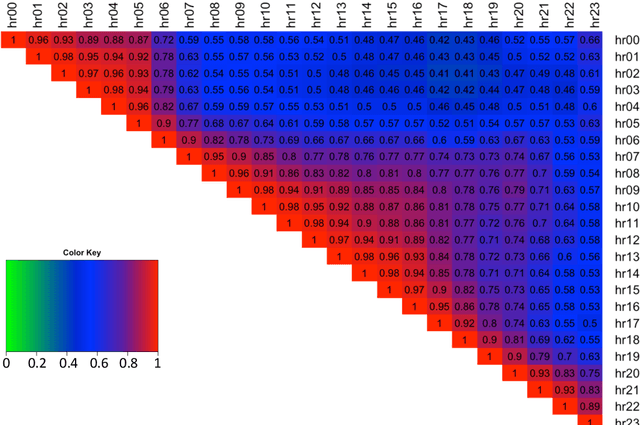

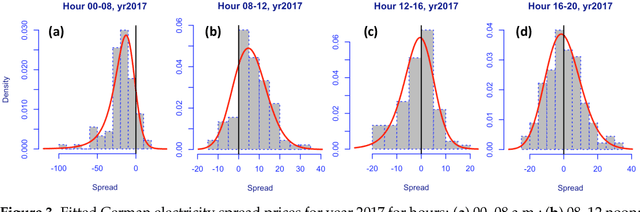

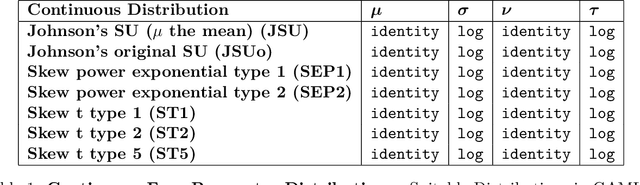

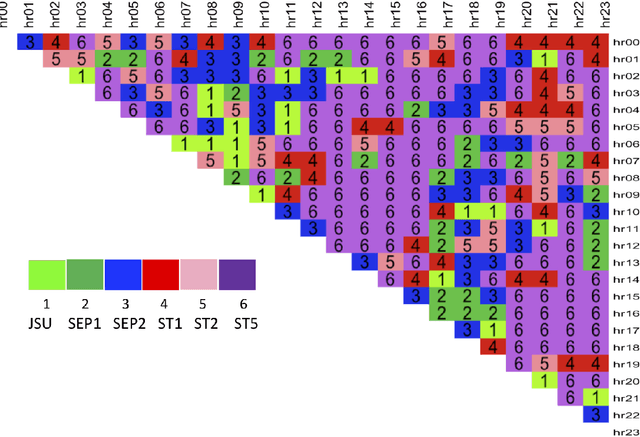

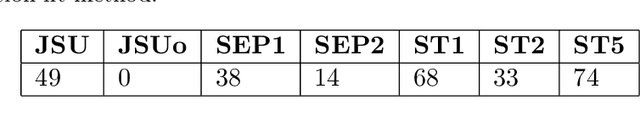

Abstract:Intra-day price spreads are of interest to electricity traders, storage and electric vehicle operators. This paper formulates dynamic density functions, based upon skewed-t and similar representations, to model and forecast the German electricity price spreads between different hours of the day, as revealed in the day-ahead auctions. The four specifications of the density functions are dynamic and conditional upon exogenous drivers, thereby permitting the location, scale and shape parameters of the densities to respond hourly to such factors as weather and demand forecasts. The best fitting and forecasting specifications for each spread are selected based on the Pinball Loss function, following the closed-form analytical solutions of the cumulative distribution functions.

* 31 pages, 25 figures. arXiv admin note: substantial text overlap with arXiv:1903.06668

Estimating Dynamic Conditional Spread Densities to Optimise Daily Storage Trading of Electricity

Mar 09, 2019

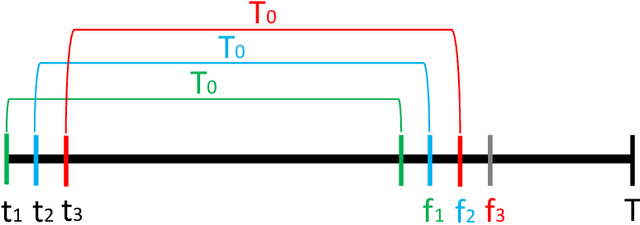

Abstract:This paper formulates dynamic density functions, based upon skewed-t and similar representations, to model and forecast electricity price spreads between different hours of the day. This supports an optimal day ahead storage and discharge schedule, and thereby facilitates a bidding strategy for a merchant arbitrage facility into the day-ahead auctions for wholesale electricity. The four latent moments of the density functions are dynamic and conditional upon exogenous drivers, thereby permitting the mean, variance, skewness and kurtosis of the densities to respond hourly to such factors as weather and demand forecasts. The best specification for each spread is selected based on the Pinball Loss function, following the closed form analytical solutions of the cumulative density functions. Those analytical properties also allow the calculation of risk associated with the spread arbitrages. From these spread densities, the optimal daily operation of a battery storage facility is determined.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge