Barack Wamkaya Wanjawa

Algorithm for Semantic Network Generation from Texts of Low Resource Languages Such as Kiswahili

Jan 16, 2025

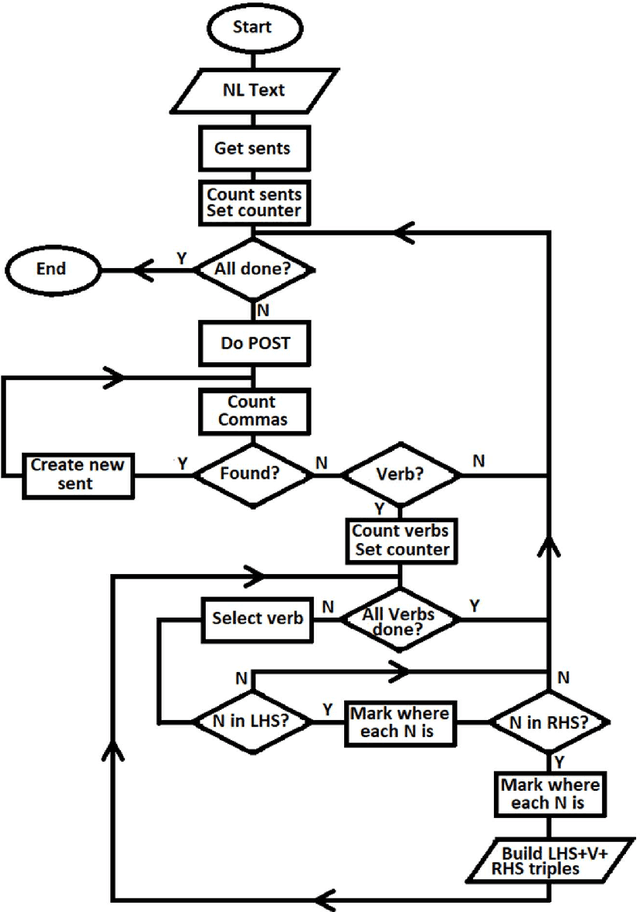

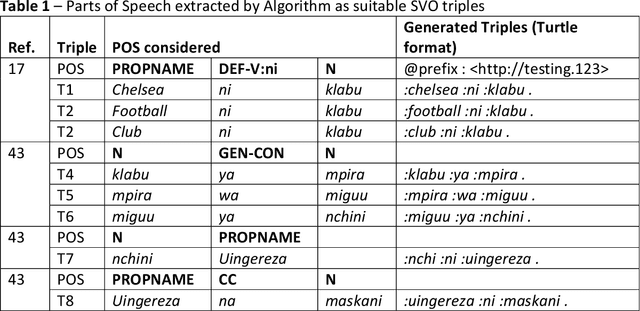

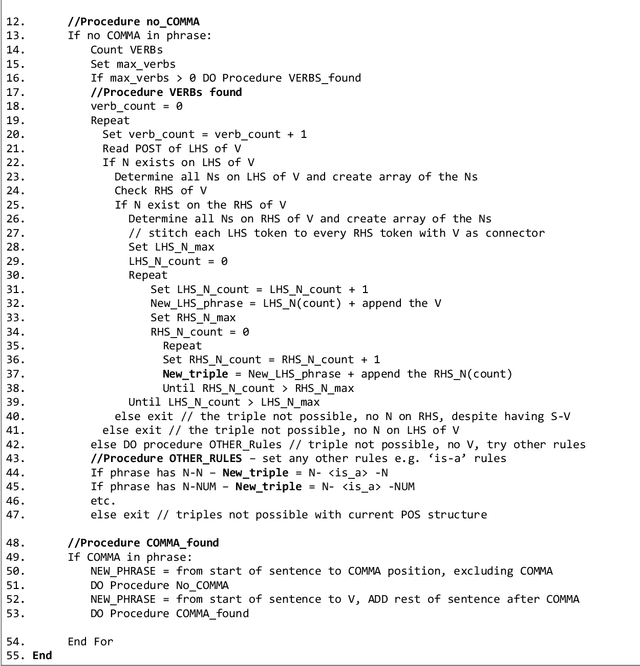

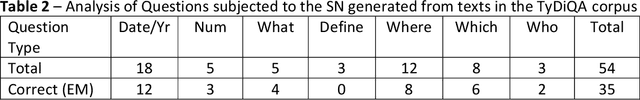

Abstract:Processing low-resource languages, such as Kiswahili, using machine learning is difficult due to lack of adequate training data. However, such low-resource languages are still important for human communication and are already in daily use and users need practical machine processing tasks such as summarization, disambiguation and even question answering (QA). One method of processing such languages, while bypassing the need for training data, is the use semantic networks. Some low resource languages, such as Kiswahili, are of the subject-verb-object (SVO) structure, and similarly semantic networks are a triple of subject-predicate-object, hence SVO parts of speech tags can map into a semantic network triple. An algorithm to process raw natural language text and map it into a semantic network is therefore necessary and desirable in structuring low resource languages texts. This algorithm tested on the Kiswahili QA task with upto 78.6% exact match.

* 18 pages, 3 figures, published in Open Journal for Information Technology

Evaluating the Performance of ANN Prediction System at Shanghai Stock Market in the Period 21-Sep-2016 to 11-Oct-2016

Dec 05, 2016

Abstract:This research evaluates the performance of an Artificial Neural Network based prediction system that was employed on the Shanghai Stock Exchange for the period 21-Sep-2016 to 11-Oct-2016. It is a follow-up to a previous paper in which the prices were predicted and published before September 21. Stock market price prediction remains an important quest for investors and researchers. This research used an Artificial Intelligence system, being an Artificial Neural Network that is feedforward multi-layer perceptron with error backpropagation for prediction, unlike other methods such as technical, fundamental or time series analysis. While these alternative methods tend to guide on trends and not the exact likely prices, neural networks on the other hand have the ability to predict the real value prices, as was done on this research. Nonetheless, determination of suitable network parameters remains a challenge in neural network design, with this research settling on a configuration of 5:21:21:1 with 80% training data or 4-year of training data as a good enough model for stock prediction, as already determined in a previous research by the author. The comparative results indicate that neural network can predict typical stock market prices with mean absolute percentage errors that are as low as 1.95% over the ten prediction instances that was studied in this research.

Predicting Future Shanghai Stock Market Price using ANN in the Period 21-Sep-2016 to 11-Oct-2016

Sep 17, 2016

Abstract:Predicting the prices of stocks at any stock market remains a quest for many investors and researchers. Those who trade at the stock market tend to use technical, fundamental or time series analysis in their predictions. These methods usually guide on trends and not the exact likely prices. It is for this reason that Artificial Intelligence systems, such as Artificial Neural Network, that is feedforward multi-layer perceptron with error backpropagation, can be used for such predictions. A difficulty in neural network application is the determination of suitable network parameters. A previous research by the author already determined the network parameters as 5:21:21:1 with 80% training data or 4-year of training data as a good enough model for stock prediction. This model has been put to the test in predicting selected Shanghai Stock Exchange stocks in the future period of 21-Sep-2016 to 11-Oct-2016, about one week after the publication of these predictions. The research aims at confirming that simple neural network systems can be quite powerful in typical stock market predictions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge