Arunav Gupta

On Feature Scaling of Recursive Feature Machines

Mar 28, 2023

Abstract:In this technical report, we explore the behavior of Recursive Feature Machines (RFMs), a type of novel kernel machine that recursively learns features via the average gradient outer product, through a series of experiments on regression datasets. When successively adding random noise features to a dataset, we observe intriguing patterns in the Mean Squared Error (MSE) curves with the test MSE exhibiting a decrease-increase-decrease pattern. This behavior is consistent across different dataset sizes, noise parameters, and target functions. Interestingly, the observed MSE curves show similarities to the "double descent" phenomenon observed in deep neural networks, hinting at new connection between RFMs and neural network behavior. This report lays the groundwork for future research into this peculiar behavior.

Quantifying the Effects of the 2008 Recession using the Zillow Dataset

Dec 23, 2019

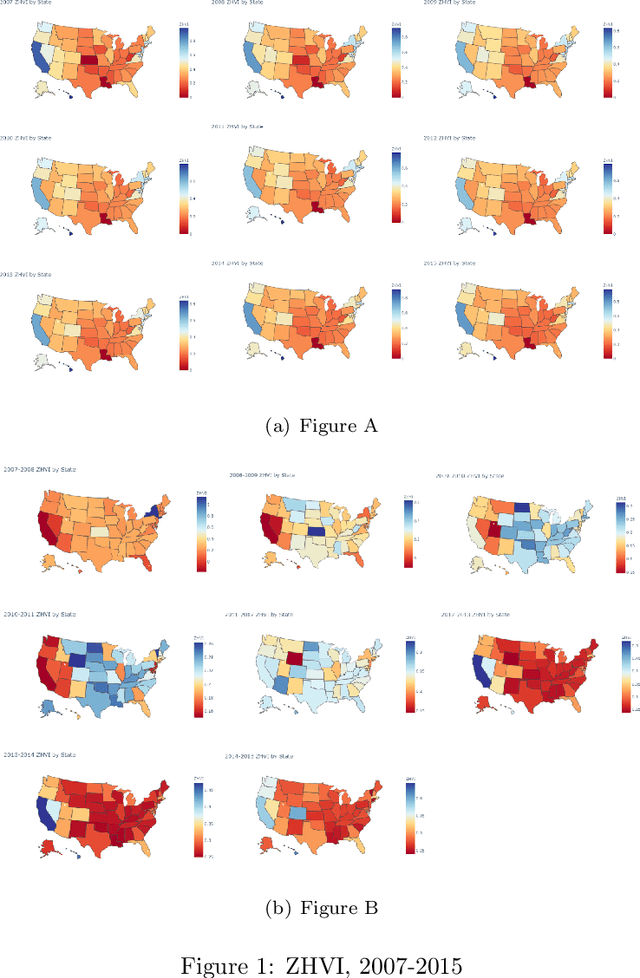

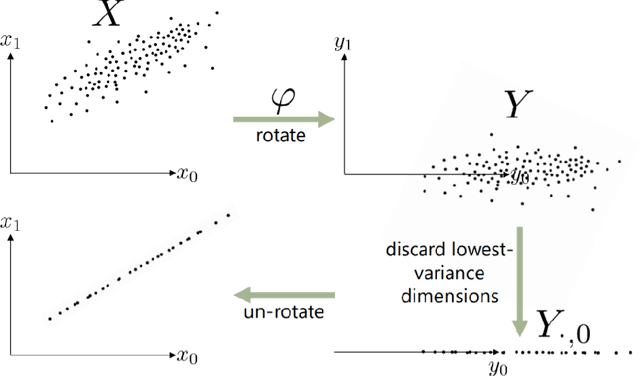

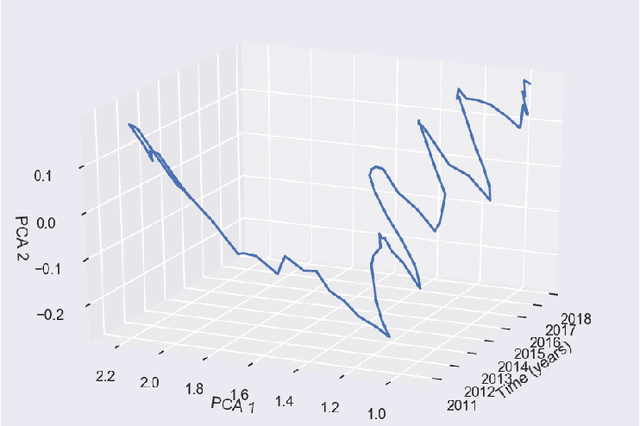

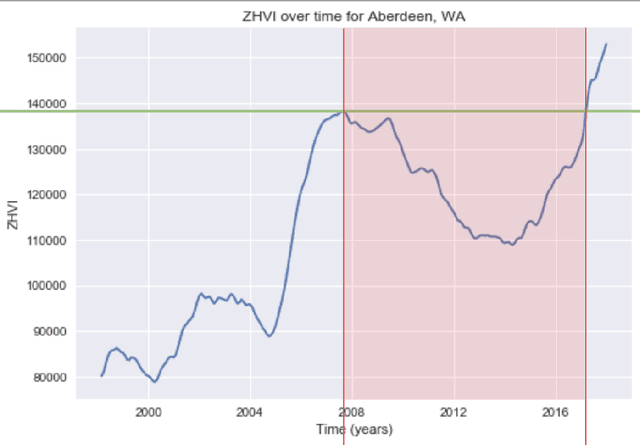

Abstract:This report explores the use of Zillow's housing metrics dataset to investigate the effects of the 2008 US subprime mortgage crisis on various US locales. We begin by exploring the causes of the recession and the metrics available to us in the dataset. We settle on using the Zillow Home Value Index (ZHVI) because it is seasonally adjusted and able to account for a variety of inventory factors. Then, we explore three methodologies for quantifying recession impact: (a) Principal Components Analysis, (b) Area Under Baseline, and (c) ARIMA modeling and Confidence Intervals. While PCA does not yield useable results, we ended up with six cities from both AUB and ARIMA analysis, the top 3 "losers" and "gainers" of the 2008 recession, as determined by each analysis. This gave us 12 cities in total. Finally, we tested the robustness of our analysis against three "common knowledge" metrics for the recession: geographic clustering, population trends, and unemployment rate. While we did find some overlap between the results of our analysis and geographic clustering, there was no positive regression outcome from comparing our methodologies to population trends and the unemployment rate.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge