Tracking Turbulence Through Financial News During COVID-19

Paper and Code

Sep 09, 2021

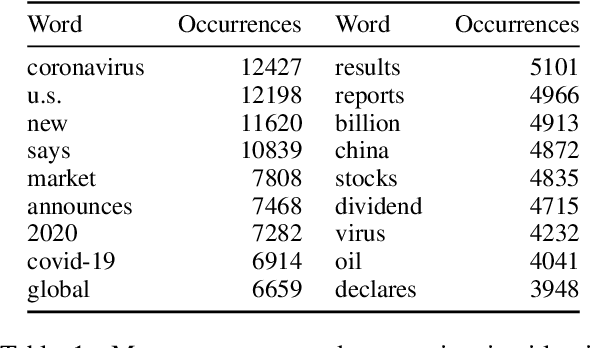

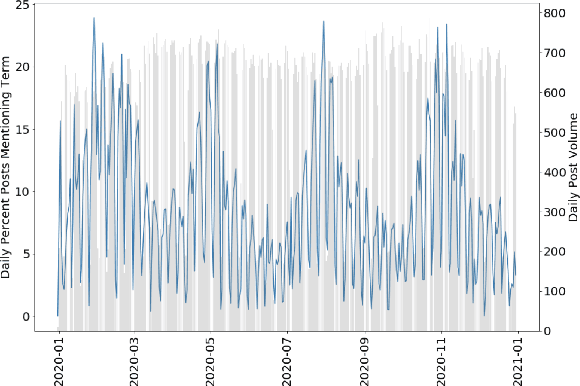

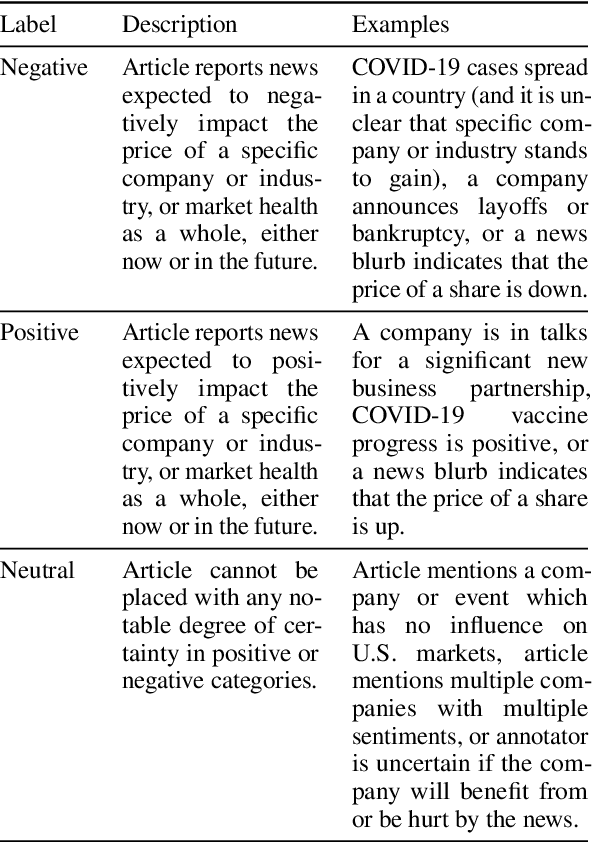

Grave human toll notwithstanding, the COVID-19 pandemic created uniquely unstable conditions in financial markets. In this work we uncover and discuss relationships involving sentiment in financial publications during the 2020 pandemic-motivated U.S. financial crash. First, we introduce a set of expert annotations of financial sentiment for articles from major American financial news publishers. After an exploratory data analysis, we then describe a CNN-based architecture to address the task of predicting financial sentiment in this anomalous, tumultuous setting. Our best performing model achieves a maximum weighted F1 score of 0.746, establishing a strong performance benchmark. Using predictions from our top performing model, we close by conducting a statistical correlation study with real stock market data, finding interesting and strong relationships between financial news and the S\&P 500 index, trading volume, market volatility, and different single-factor ETFs.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge