Testing for Causality in Continuous Time Bayesian Network Models of High-Frequency Data

Paper and Code

Jan 25, 2016

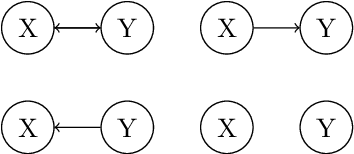

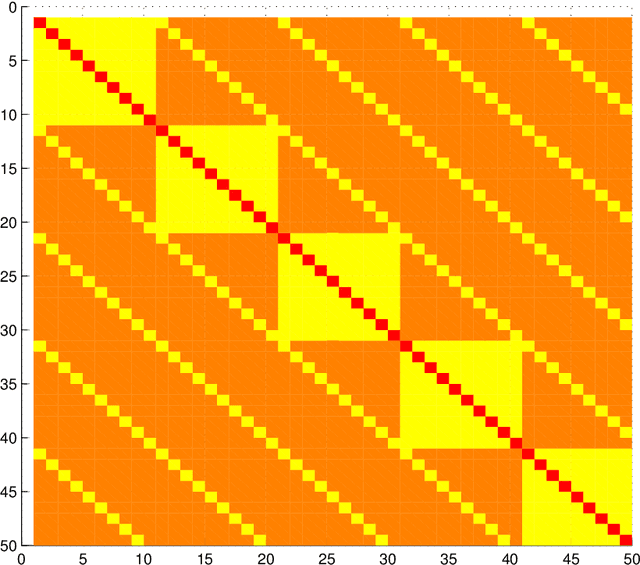

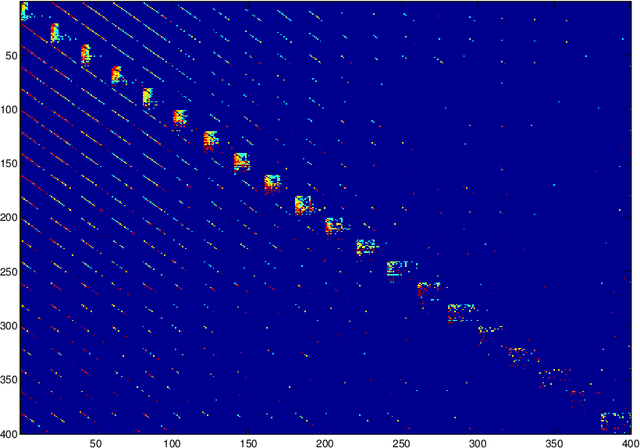

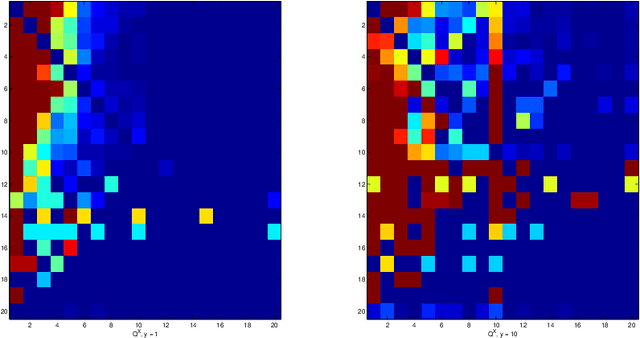

Continuous time Bayesian networks are investigated with a special focus on their ability to express causality. A framework is presented for doing inference in these networks. The central contributions are a representation of the intensity matrices for the networks and the introduction of a causality measure. A new model for high-frequency financial data is presented. It is calibrated to market data and by the new causality measure it performs better than older models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge