Social learning via actions in bandit environments

Paper and Code

May 12, 2022

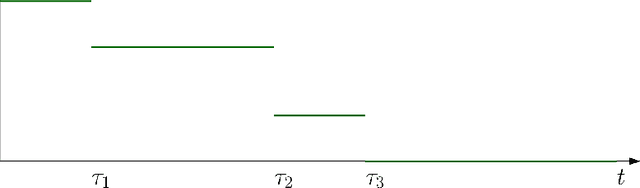

I study a game of strategic exploration with private payoffs and public actions in a Bayesian bandit setting. In particular, I look at cascade equilibria, in which agents switch over time from the risky action to the riskless action only when they become sufficiently pessimistic. I show that these equilibria exist under some conditions and establish their salient properties. Individual exploration in these equilibria can be more or less than the single-agent level depending on whether the agents start out with a common prior or not, but the most optimistic agent always underexplores. I also show that allowing the agents to write enforceable ex-ante contracts will lead to the most ex-ante optimistic agent to buy all payoff streams, providing an explanation to the buying out of smaller start-ups by more established firms.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge