Practical Deep Reinforcement Learning Approach for Stock Trading

Paper and Code

Dec 02, 2018

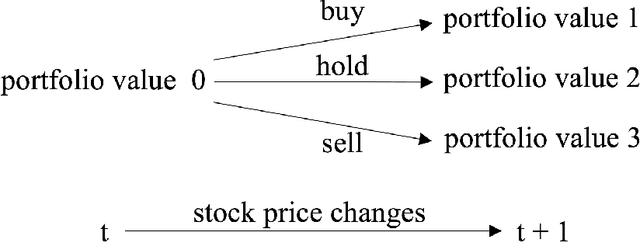

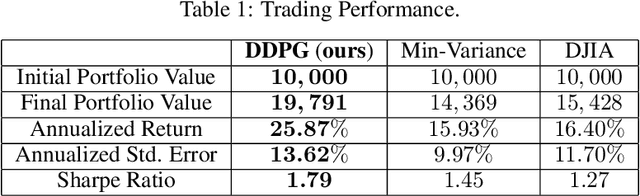

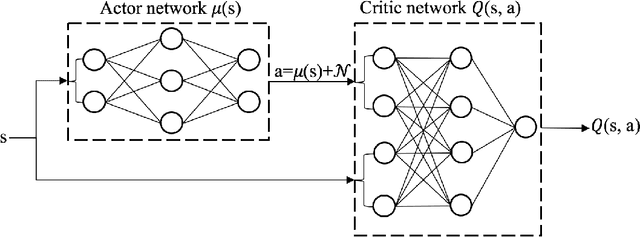

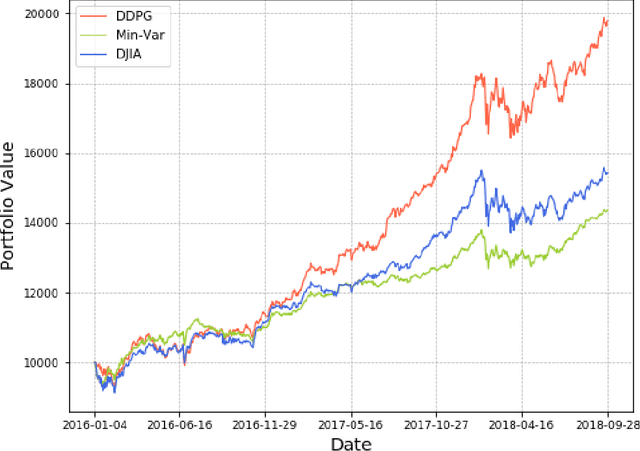

Stock trading strategy plays a crucial role in investment companies. However, it is challenging to obtain optimal strategy in the complex and dynamic stock market. We explore the potential of deep reinforcement learning to optimize stock trading strategy and thus maximize investment return. 30 stocks are selected as our trading stocks and their daily prices are used as the training and trading market environment. We train a deep reinforcement learning agent and obtain an adaptive trading strategy. The agent's performance is evaluated and compared with Dow Jones Industrial Average and the traditional min-variance portfolio allocation strategy. The proposed deep reinforcement learning approach is shown to outperform the two baselines in terms of both the Sharpe ratio and cumulative returns.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge