Online Prediction With History-Dependent Experts: The General Case

Paper and Code

Jul 31, 2020

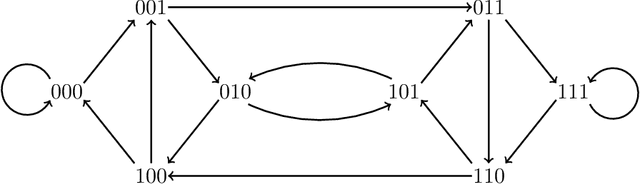

We study the problem of prediction of binary sequences with expert advice in the online setting, which is a classic example of online machine learning. We interpret the binary sequence as the price history of a stock, and view the predictor as an investor, which converts the problem into a stock prediction problem. In this framework, an investor, who predicts the daily movements of a stock, and an adversarial market, who controls the stock, play against each other over $N$ turns. The investor combines the predictions of $n\geq 2$ experts in order to make a decision about how much to invest at each turn, and aims to minimize their regret with respect to the best-performing expert at the end of the game. We consider the problem with history-dependent experts, in which each expert uses the previous $d$ days of history of the market in making their predictions. We prove that the value function for this game, rescaled appropriately, converges as $N\to \infty$ at a rate of $O(N^{-1/6})$ to the viscosity solution of a nonlinear degenerate elliptic PDE, which can be understood as the Hamilton-Jacobi-Issacs equation for the two-person game. As a result, we are able to deduce asymptotically optimal strategies for the investor. Our results extend those established by the first author and R.V.Kohn [13] for $n=2$ experts and $d\leq 4$ days of history.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge