MegazordNet: combining statistical and machine learning standpoints for time series forecasting

Paper and Code

Jun 23, 2021

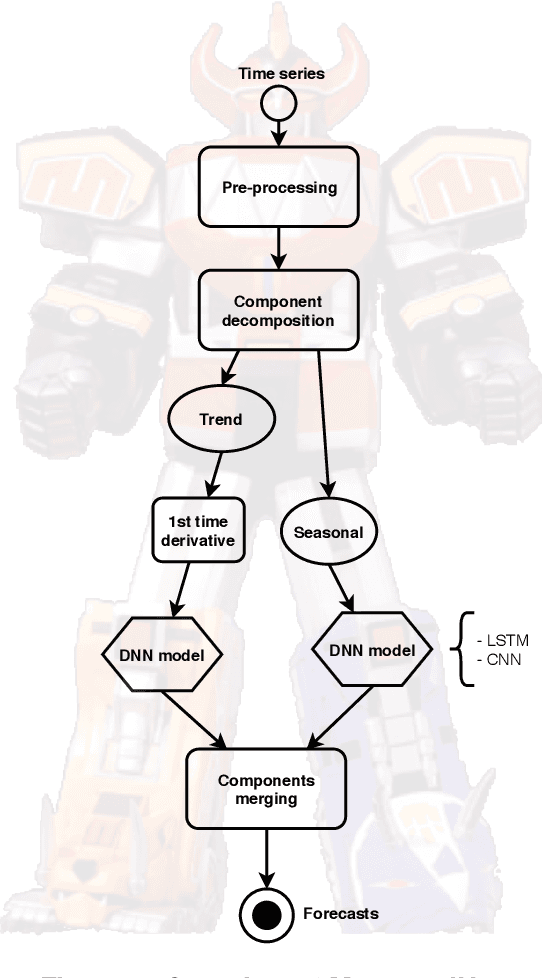

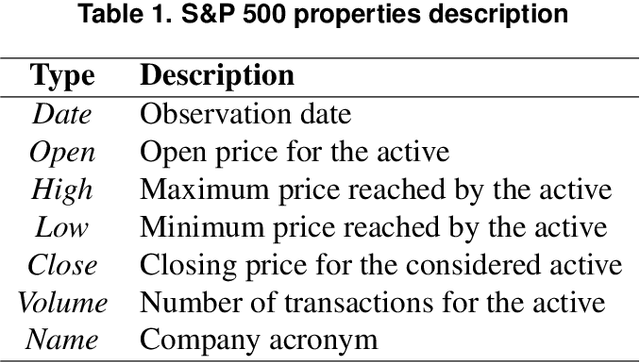

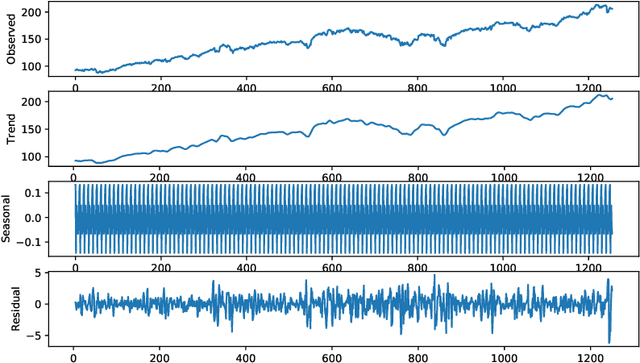

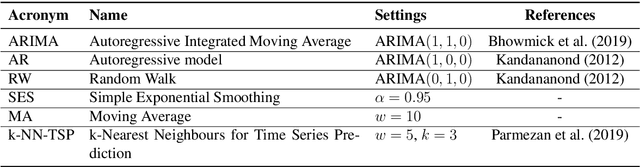

Forecasting financial time series is considered to be a difficult task due to the chaotic feature of the series. Statistical approaches have shown solid results in some specific problems such as predicting market direction and single-price of stocks; however, with the recent advances in deep learning and big data techniques, new promising options have arises to tackle financial time series forecasting. Moreover, recent literature has shown that employing a combination of statistics and machine learning may improve accuracy in the forecasts in comparison to single solutions. Taking into consideration the mentioned aspects, in this work, we proposed the MegazordNet, a framework that explores statistical features within a financial series combined with a structured deep learning model for time series forecasting. We evaluated our approach predicting the closing price of stocks in the S&P 500 using different metrics, and we were able to beat single statistical and machine learning methods.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge