Managers versus Machines: Do Algorithms Replicate Human Intuition in Credit Ratings?

Paper and Code

Feb 09, 2022

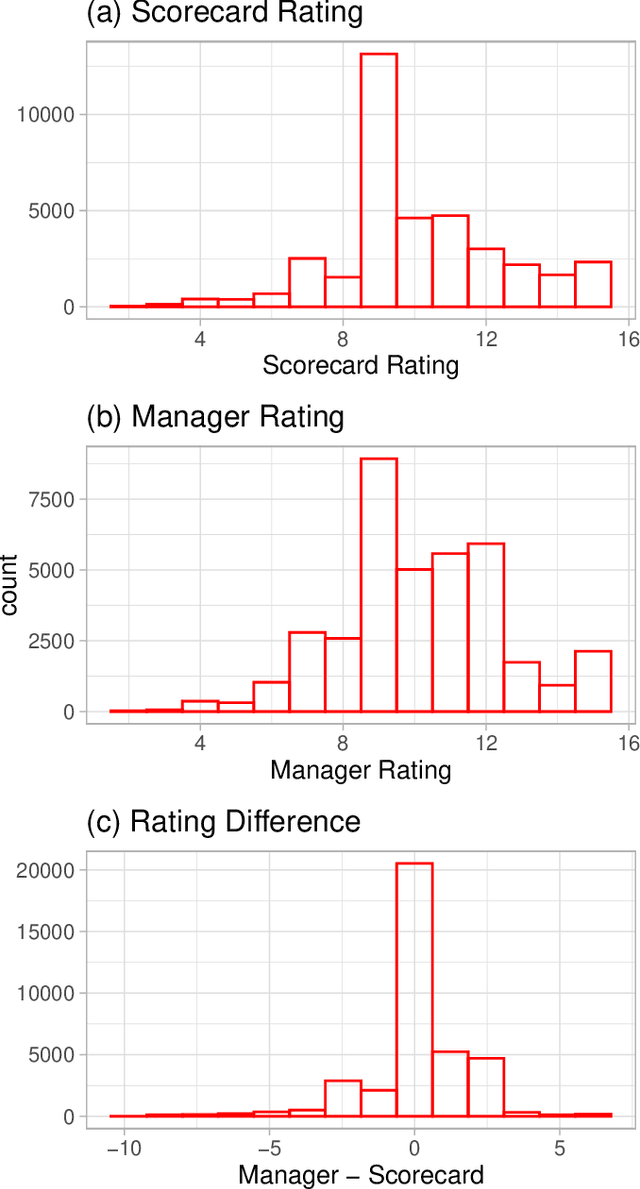

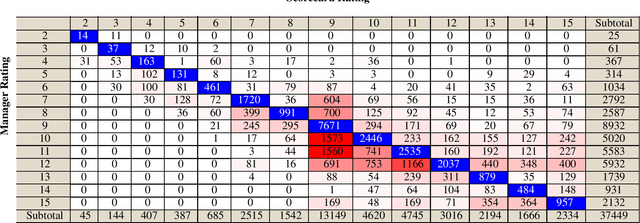

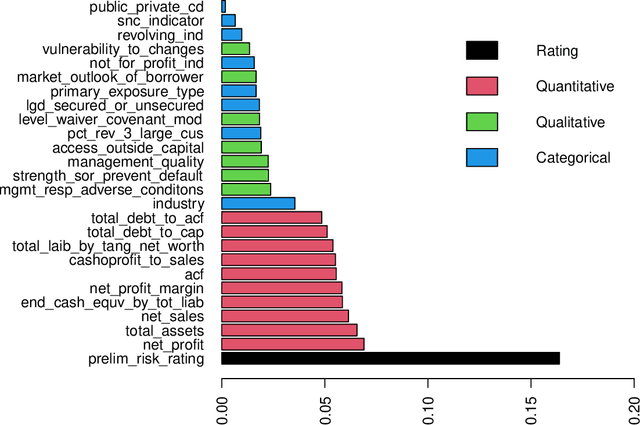

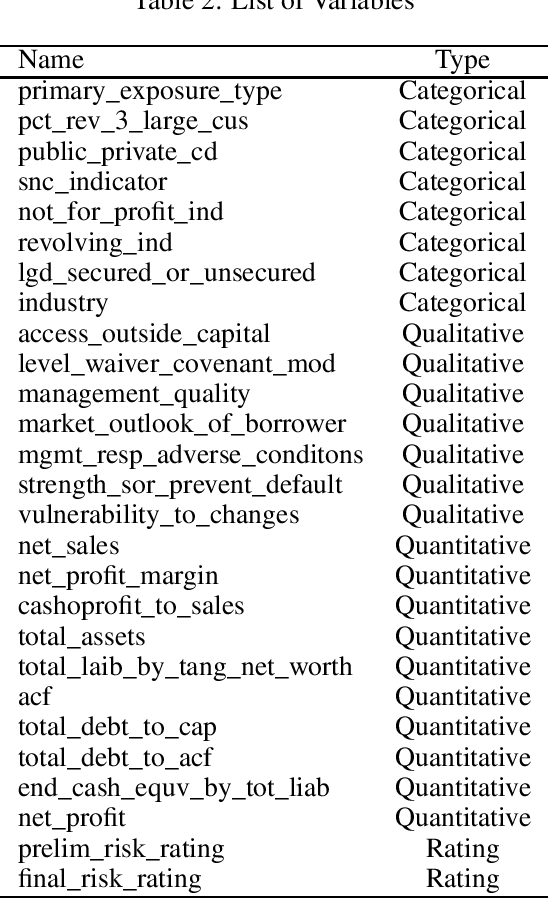

We use machine learning techniques to investigate whether it is possible to replicate the behavior of bank managers who assess the risk of commercial loans made by a large commercial US bank. Even though a typical bank already relies on an algorithmic scorecard process to evaluate risk, bank managers are given significant latitude in adjusting the risk score in order to account for other holistic factors based on their intuition and experience. We show that it is possible to find machine learning algorithms that can replicate the behavior of the bank managers. The input to the algorithms consists of a combination of standard financials and soft information available to bank managers as part of the typical loan review process. We also document the presence of significant heterogeneity in the adjustment process that can be traced to differences across managers and industries. Our results highlight the effectiveness of machine learning based analytic approaches to banking and the potential challenges to high-skill jobs in the financial sector.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge