Leveraging Multiple Online Sources for Accurate Income Verification

Paper and Code

Jun 19, 2021

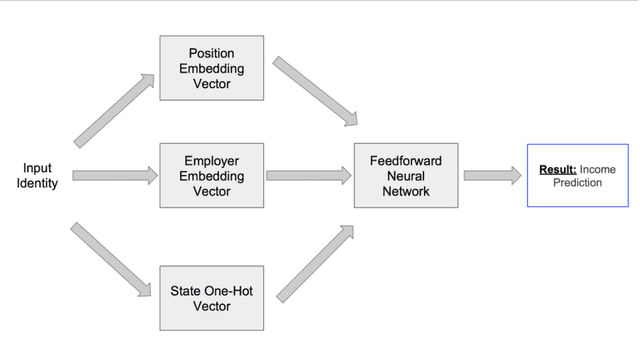

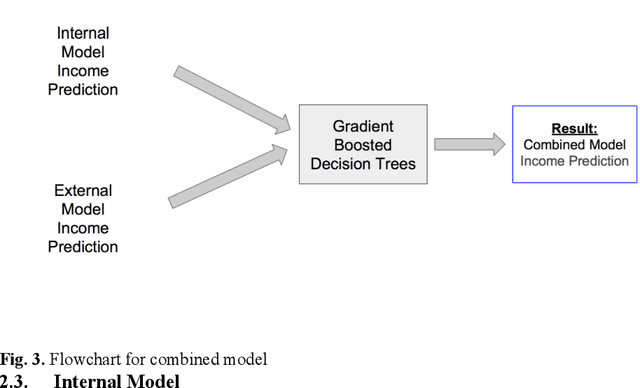

Income verification is the problem of validating a person's stated income given basic identity information such as name, location, job title and employer. It is widely used in the context of mortgage lending, rental applications and other financial risk models. However, the current processes surrounding verification involve significant human effort and document gathering which can be both time-consuming and expensive. In this paper, we propose a novel model for verifying an individual's income given very limited identity information typically available in loan applications. Our model is a combination of a deep neural network and hand-engineered features. The hand engineered features are based upon matching the input information against income records extracted automatically from various publicly available online sources (e.g. payscale.com, H-1B filings, government employee salaries). We conduct experiments on two data sets, one simulated from H-1B records and the other from a real-world data set of peer-to-peer (P2P) loan applications obtained from one of the world's largest P2P lending platform. Our results show a significant reduction in error of 3-6% relative to several strong baselines. We also perform ablation studies to demonstrate that a combined model is indeed necessary to achieve state-of-the-art performance on this task.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge