Index Tracking via Learning to Predict Market Sensitivities

Paper and Code

Sep 02, 2022

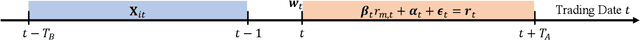

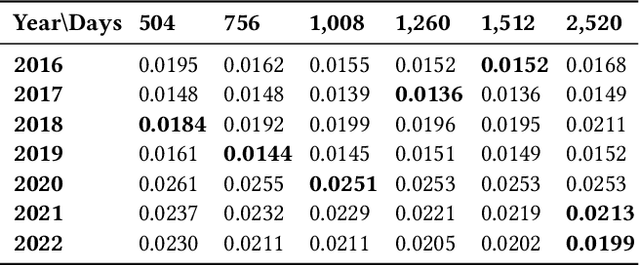

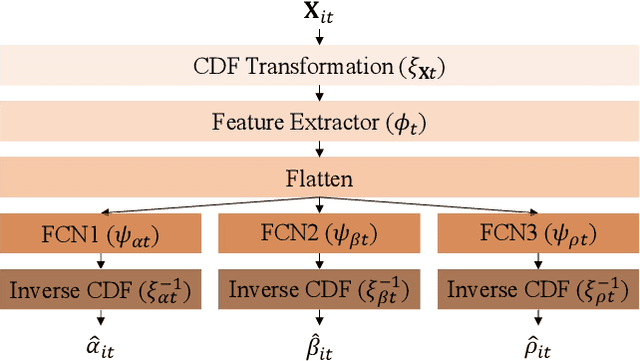

A significant number of equity funds are preferred by index funds nowadays, and market sensitivities are instrumental in managing them. Index funds might replicate the index identically, which is, however, cost-ineffective and impractical. Moreover, to utilize market sensitivities to replicate the index partially, they must be predicted or estimated accurately. Accordingly, first, we examine deep learning models to predict market sensitivities. Also, we present pragmatic applications of data processing methods to aid training and generate target data for the prediction. Then, we propose a partial-index-tracking optimization model controlling the net predicted market sensitivities of the portfolios and index to be the same. These processes' efficacy is corroborated by the Korea Stock Price Index 200. Our experiments show a significant reduction of the prediction errors compared with historical estimations, and competitive tracking errors of replicating the index using fewer than half of the entire constituents. Therefore, we show that applying deep learning to predict market sensitivities is promising and that our portfolio construction methods are practically effective. Additionally, to our knowledge, this is the first study that addresses market sensitivities focused on deep learning.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge