Firm-based relatedness using machine learning

Paper and Code

Feb 01, 2022

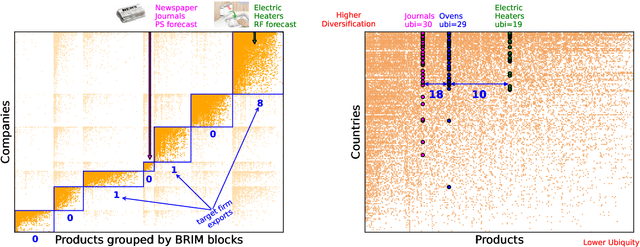

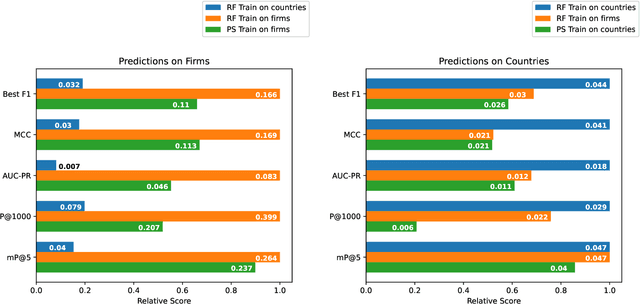

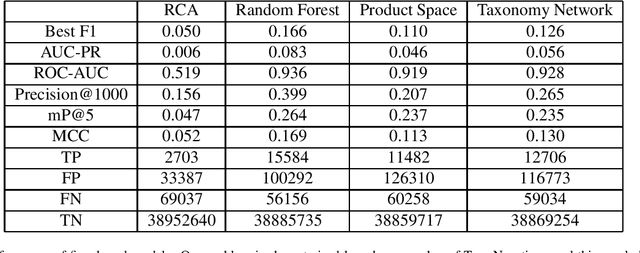

The relatedness between an economic actor (for instance a country, or a firm) and a product is a measure of the feasibility of that economic activity. As such, it is a driver for investments both at a private and institutional level. Traditionally, relatedness is measured using complex networks approaches derived by country-level co-occurrences. In this work, we compare complex networks and machine learning algorithms trained on both country and firm-level data. In order to quantitatively compare the different measures of relatedness, we use them to predict the future exports at country and firm-level, assuming that more related products have higher likelihood to be exported in the near future. Our results show that relatedness is scale-dependent: the best assessments are obtained by using machine learning on the same typology of data one wants to predict. Moreover, while relatedness measures based on country data are not suitable for firms, firm-level data are quite informative also to predict the development of countries. In this sense, models built on firm data provide a better assessment of relatedness with respect to country-level data. We also discuss the effect of using community detection algorithms and parameter optimization, finding that a partition into a higher number of blocks decreases the computational time while maintaining a prediction performance that is well above the network based benchmarks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge