Finding Optimal Trading History in Reinforcement Learning for Stock Market Trading

Paper and Code

Feb 19, 2025

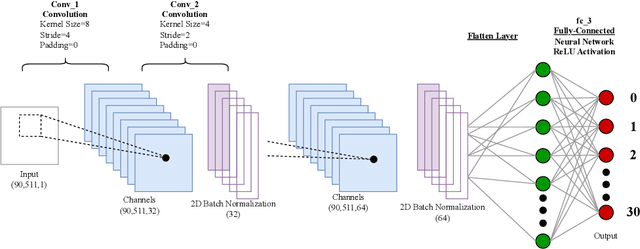

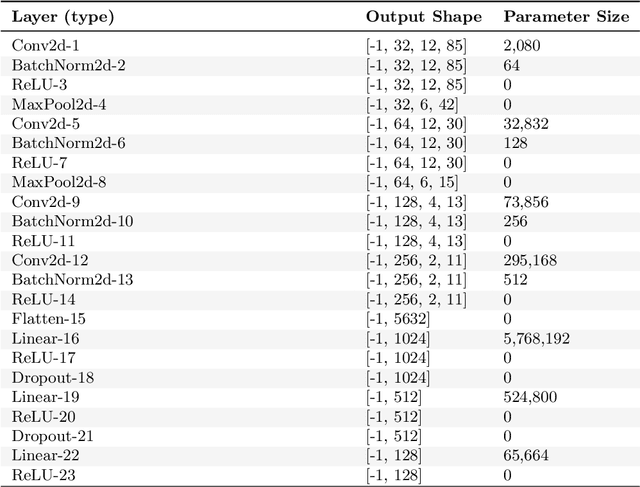

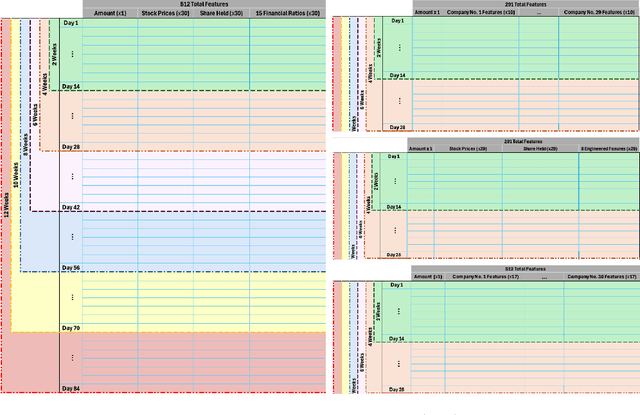

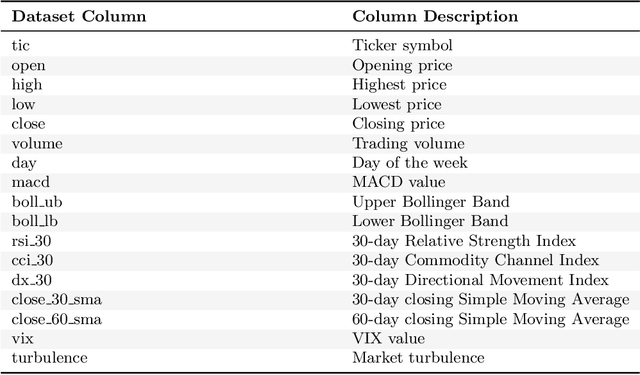

This paper investigates the optimization of temporal windows in Financial Deep Reinforcement Learning (DRL) models using 2D Convolutional Neural Networks (CNNs). We introduce a novel approach to treating the temporal field as a hyperparameter and examine its impact on model performance across various datasets and feature arrangements. We introduce a new hyperparameter for the CNN policy, proposing that this temporal field can and should be treated as a hyperparameter for these models. We examine the significance of this temporal field by iteratively expanding the window of observations presented to the CNN policy during the deep reinforcement learning process. Our iterative process involves progressively increasing the observation period from two weeks to twelve weeks, allowing us to examine the effects of different temporal windows on the model's performance. This window expansion is implemented in two settings. In one setting, we rearrange the features in the dataset to group them by company, allowing the model to have a full view of company data in its observation window and CNN kernel. In the second setting, we do not group the features by company, and features are arranged by category. Our study reveals that shorter temporal windows are most effective when no feature rearrangement to group per company is in effect. However, the model will utilize longer temporal windows and yield better performance once we introduce the feature rearrangement. To examine the consistency of our findings, we repeated our experiment on two datasets containing the same thirty companies from the Dow Jones Index but with different features in each dataset and consistently observed the above-mentioned patterns. The result is a trading model significantly outperforming global financial services firms such as the Global X Guru by the established Mirae Asset.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge