FactorGCL: A Hypergraph-Based Factor Model with Temporal Residual Contrastive Learning for Stock Returns Prediction

Paper and Code

Feb 05, 2025

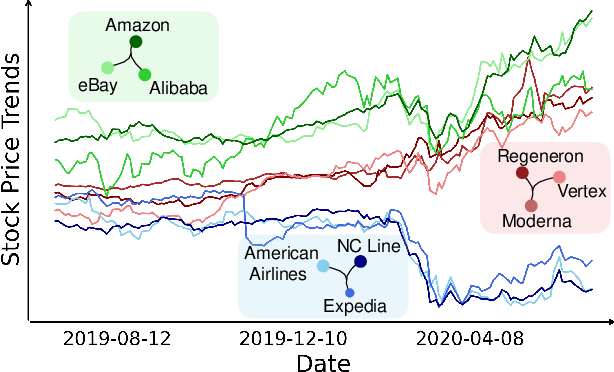

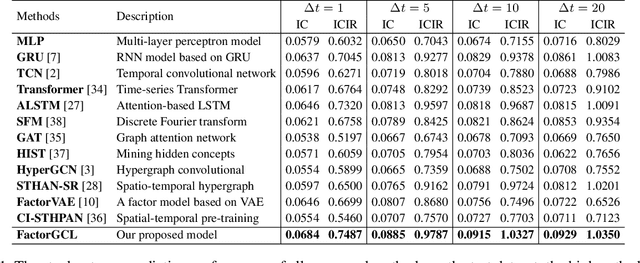

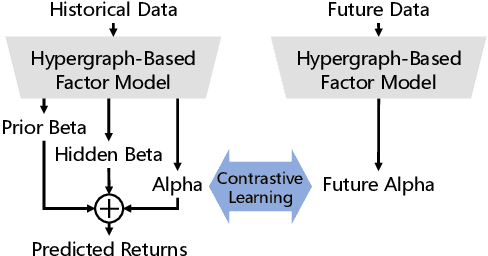

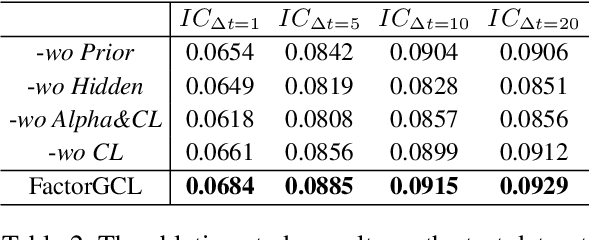

As a fundamental method in economics and finance, the factor model has been extensively utilized in quantitative investment. In recent years, there has been a paradigm shift from traditional linear models with expert-designed factors to more flexible nonlinear machine learning-based models with data-driven factors, aiming to enhance the effectiveness of these factor models. However, due to the low signal-to-noise ratio in market data, mining effective factors in data-driven models remains challenging. In this work, we propose a hypergraph-based factor model with temporal residual contrastive learning (FactorGCL) that employs a hypergraph structure to better capture high-order nonlinear relationships among stock returns and factors. To mine hidden factors that supplement human-designed prior factors for predicting stock returns, we design a cascading residual hypergraph architecture, in which the hidden factors are extracted from the residual information after removing the influence of prior factors. Additionally, we propose a temporal residual contrastive learning method to guide the extraction of effective and comprehensive hidden factors by contrasting stock-specific residual information over different time periods. Our extensive experiments on real stock market data demonstrate that FactorGCL not only outperforms existing state-of-the-art methods but also mines effective hidden factors for predicting stock returns.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge