DeepAg: Deep Learning Approach for Measuring the Effects of Outlier Events on Agricultural Production and Policy

Paper and Code

Nov 06, 2021

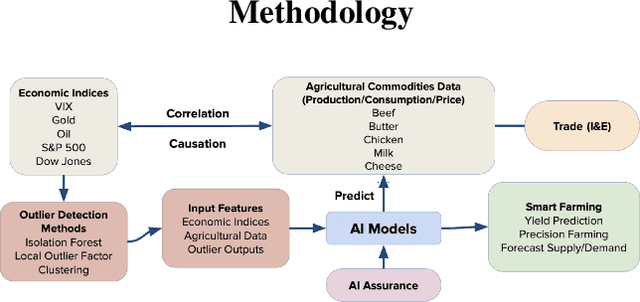

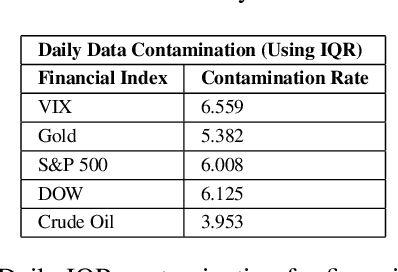

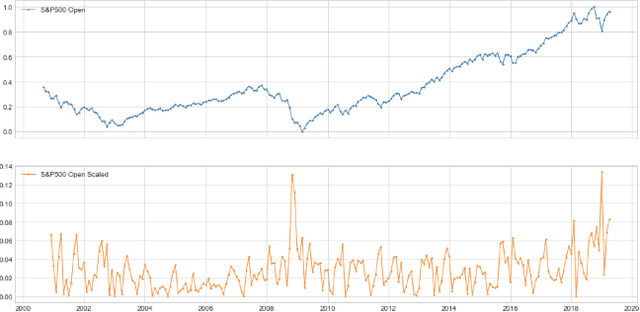

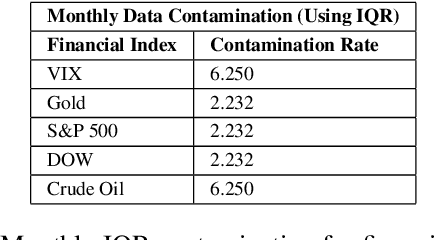

Quantitative metrics that measure the global economy's equilibrium have strong and interdependent relationships with the agricultural supply chain and international trade flows. Sudden shocks in these processes caused by outlier events such as trade wars, pandemics, or weather can have complex effects on the global economy. In this paper, we propose a novel framework, namely: DeepAg, that employs econometrics and measures the effects of outlier events detection using Deep Learning (DL) to determine relationships between commonplace financial indices (such as the DowJones), and the production values of agricultural commodities (such as Cheese and Milk). We employed a DL technique called Long Short-Term Memory (LSTM) networks successfully to predict commodity production with high accuracy and also present five popular models (regression and boosting) as baselines to measure the effects of outlier events. The results indicate that DeepAg with outliers' considerations (using Isolation Forests) outperforms baseline models, as well as the same model without outliers detection. Outlier events make a considerable impact when predicting commodity production with respect to financial indices. Moreover, we present the implications of DeepAg on public policy, provide insights for policymakers and farmers, and for operational decisions in the agricultural ecosystem. Data are collected, models developed, and the results are recorded and presented.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge