Conformal Predictive Portfolio Selection

Paper and Code

Oct 19, 2024

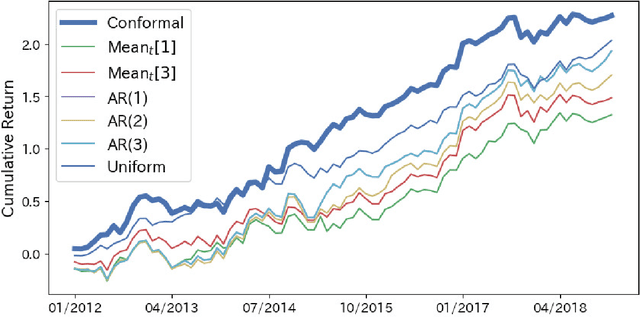

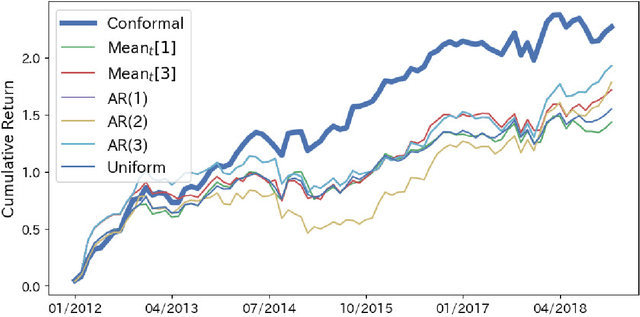

This study explores portfolio selection using predictive models for portfolio returns. Portfolio selection is a fundamental task in finance, and various methods have been developed to achieve this goal. For example, the mean-variance approach constructs portfolios by balancing the trade-off between the mean and variance of asset returns, while the quantile-based approach optimizes portfolios by accounting for tail risk. These traditional methods often rely on distributional information estimated from historical data. However, a key concern is the uncertainty of future portfolio returns, which may not be fully captured by simple reliance on historical data, such as using the sample average. To address this, we propose a framework for predictive portfolio selection using conformal inference, called Conformal Predictive Portfolio Selection (CPPS). Our approach predicts future portfolio returns, computes corresponding prediction intervals, and selects the desirable portfolio based on these intervals. The framework is flexible and can accommodate a variety of predictive models, including autoregressive (AR) models, random forests, and neural networks. We demonstrate the effectiveness of our CPPS framework using an AR model and validate its performance through empirical studies, showing that it provides superior returns compared to simpler strategies.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge