Bayesian Bilinear Neural Network for Predicting the Mid-price Dynamics in Limit-Order Book Markets

Paper and Code

Mar 07, 2022

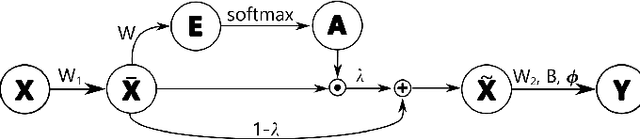

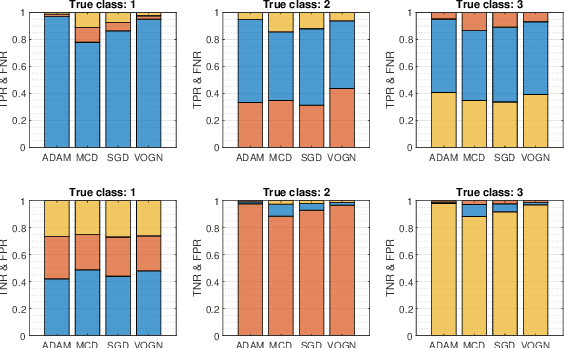

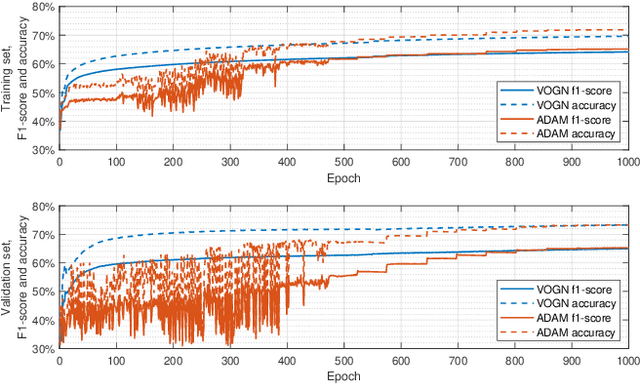

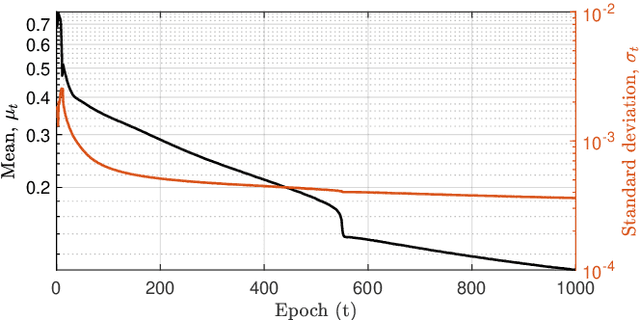

The prediction of financial markets is a challenging yet important task. In modern electronically-driven markets traditional time-series econometric methods often appear incapable of capturing the true complexity of the multi-level interactions driving the price dynamics. While recent research has established the effectiveness of traditional machine learning (ML) models in financial applications, their intrinsic inability in dealing with uncertainties, which is a great concern in econometrics research and real business applications, constitutes a major drawback. Bayesian methods naturally appear as a suitable remedy conveying the predictive ability of ML methods with the probabilistically-oriented practice of econometric research. By adopting a state-of-the-art second-order optimization algorithm, we train a Bayesian bilinear neural network with temporal attention, suitable for the challenging time-series task of predicting mid-price movements in ultra-high-frequency limit-order book markets. By addressing the use of predictive distributions to analyze errors and uncertainties associated with the estimated parameters and model forecasts, we thoroughly compare our Bayesian model with traditional ML alternatives. Our results underline the feasibility of the Bayesian deep learning approach and its predictive and decisional advantages in complex econometric tasks, prompting future research in this direction.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge